Home ownership: +2.7% over the previous year.

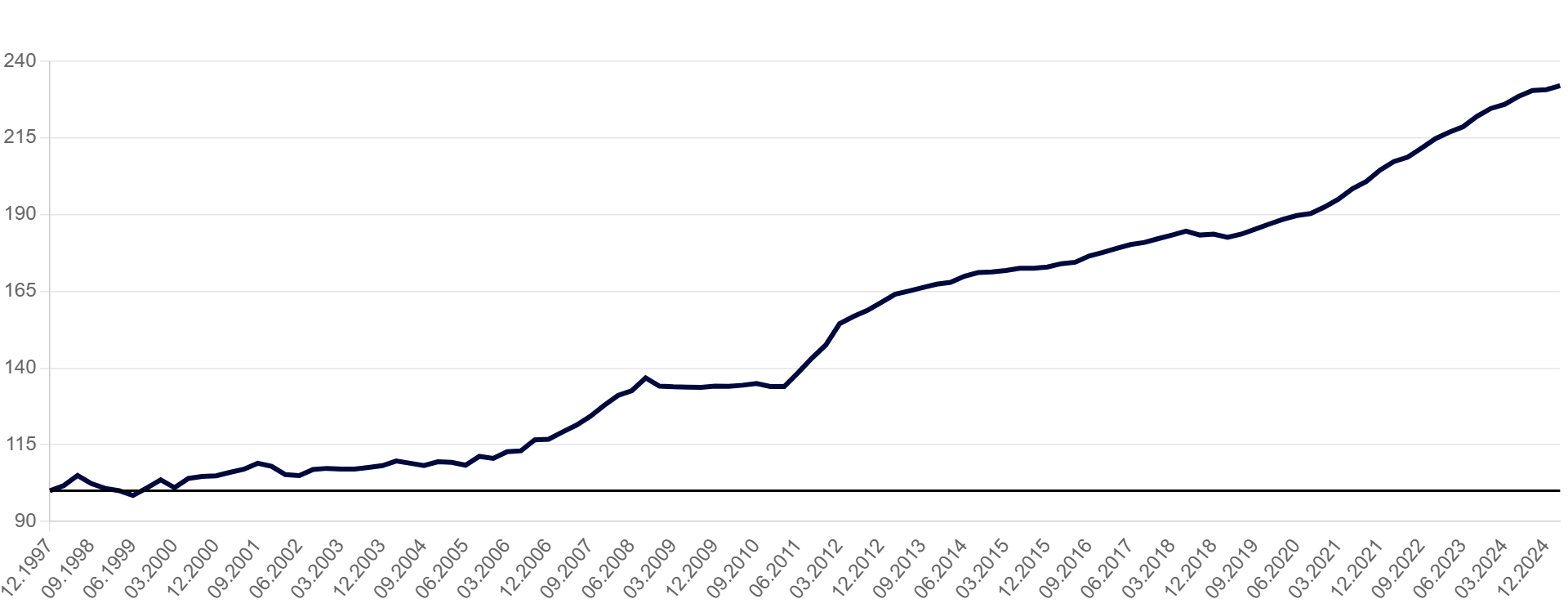

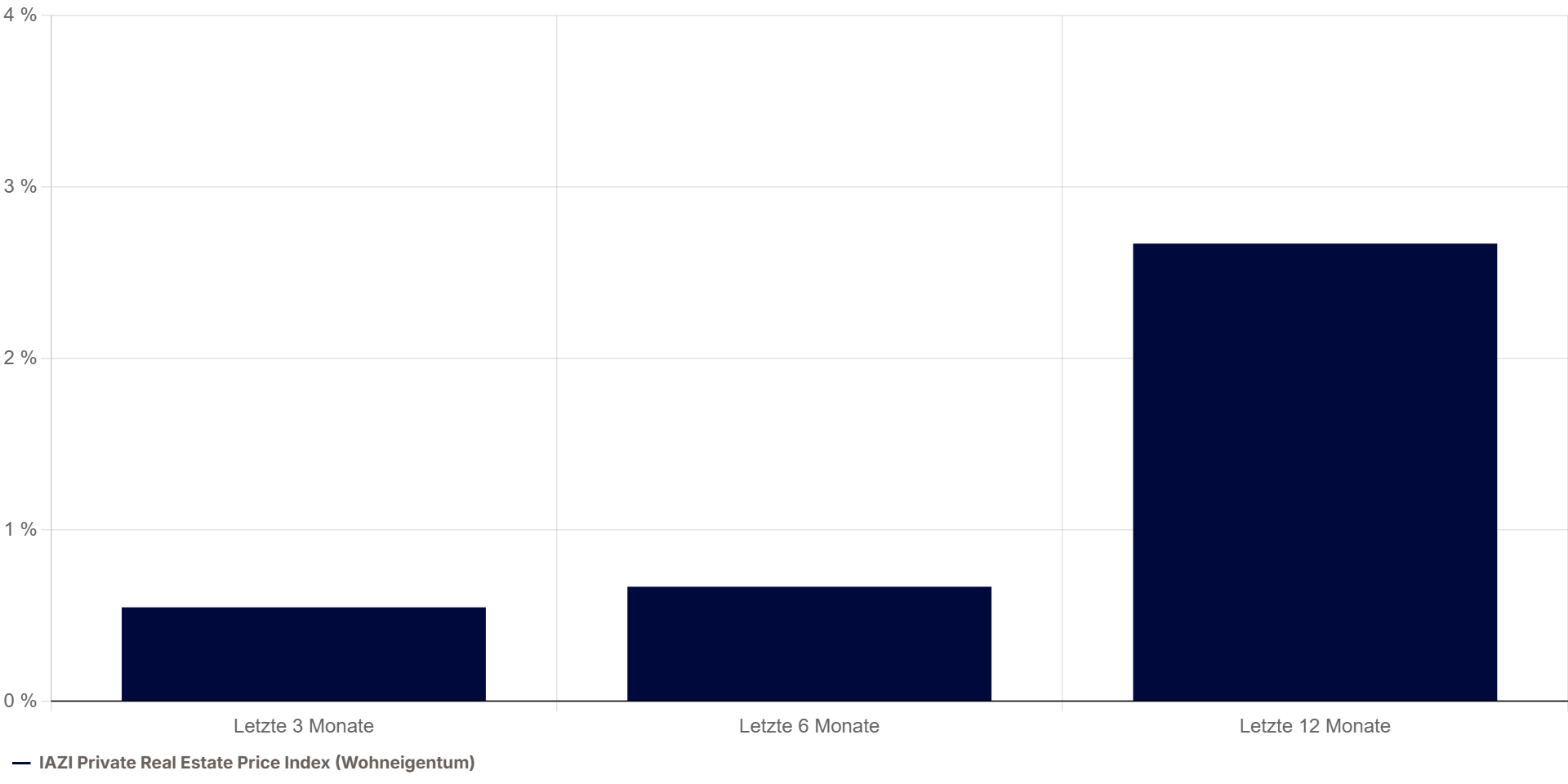

16.04.2025The IAZI AG regularly publishes figures on the price development of privately used residential property, apartment buildings and investment properties based on effective changes of ownership on the open market with its “IAZI Private Real Estate Price Index”. After a short breather, the company found that transaction prices for owner-occupied residential property had risen slightly again in the first quarter of 2025. Although the 0.6% increase was slightly below the long-term average, it signaled a renewed revival in the market. It is striking that the willingness to pay for single-family houses (+0.5%) grew again after a minimal decline in the previous quarter. At +0.6%, the increase for condominiums is practically the same and only insignificantly higher than the previous quarter’s figure. Within a year, a price increase of 2.7% has been realized for residential property.

Home ownership offers financial security

According to the IAZI, demand was supported not least by persistently low mortgage interest rates. “Due to its high intrinsic value, home ownership also offers a high degree of financial security. In politically and economically uncertain times, characterized by turbulence in the financial and energy markets, trade conflicts and the turmoil of war, residential property in a reliable and well-managed country like Switzerland proves to be a safe haven.”

Slight decline in apartment buildings

By contrast, transaction prices for apartment buildings in the first quarter of 2025 recorded a further slight decline of 0.2%, as shown by the “IAZI Investment Real Estate Price Index”. This reflects the price development of residential and mixed-use investment properties, with only transactions with bank financing included in the calculation. Over the past twelve months, this submarket has seen comparatively moderate growth of 1.0%.

Market commentary by Donato Scognamiglio on the real estate indices in the first quarter of 2025

Watch Donato Scognamiglio’s market commentary on the developments in the real estate indices on YouTube:

Cautious lending slows down the market for investment properties

The restraint already observed in the market for investment properties in previous quarters thus continues, IAZI notes. This is likely to be due, not least, to the more cautious lending policies of mortgage institutions in the current economic environment. This tendency is reinforced by the higher equity requirements that have been in force since the beginning of the year as part of the Basel III regulatory framework.

In addition, the current financing policy of the banks is noticeably slowing down construction activity. Numerous projects have to be implemented in a redimensioned form or abandoned altogether due to a lack of sufficient external financing.

Uncertainties in the interest rate market

The medium to long-term development of interest rates, one of the key factors for the real estate market, is an additional source of uncertainty. Key interest rates have been lowered by the majority of central banks in their latest decisions, which increases the attractiveness of real estate as an investment. However, if inflationary pressure increases again due to growing government spending and trade barriers, interest rate hikes could certainly become a possibility again.