Who benefits from the abolition of the imputed rental value?

01.03.2025Parliament has decided: The imputed rental value is to be abolished. The bill now has to be voted on by the people and the cantons at the ballot box. According to Raiffeisen Switzerland in a press release, “If the proposal is voted in favour, homeowners would achieve considerable tax savings in some cases, depending on the type of household, given the prevailing low interest rates. Thanks to the high first-time buyer deduction, newly married couples would benefit the most from the reform. Households with low mortgages, such as many pensioner households, would also be among the winners of the reform.”

However, owners of properties in need of refurbishment would see less relief, as value-preserving refurbishment work could no longer be deducted from taxable income following the abolition of the imputed rental value.

All the details on the winners and losers if the imputed rental value is abolished can be found in the Raiffeisen report “Immobilien Schweiz – 1Q 2025; Was, wenn der Eigenmietwert fällt?”, which you can download here as a PDF.

Value of residential property benefits noticeably from the abolition of imputed rental value

Raiffeisen writes: “If the imputed rental value is abolished, residential property would become noticeably more financially attractive overall in the current market environment and consequently also increase in value. However, homes in need of renovation are likely to lose value due to the elimination of deferred tax deductions as a result of the reform.” “One of the potential losers of the reform is the construction industry. Although it is likely to benefit from many last-minute orders in the short term during the transition phase until the reform comes into force, in the long term fewer funds will flow into the renovation of residential buildings due to the elimination of a large proportion of tax maintenance deductions,” explains Fredy Hasenmaile, Chief Economist at Raiffeisen Switzerland.

“If the prevailing interest rate environment remains the same, the tax authorities would also have to reckon with billions in lower revenue for years to come as a result of the reform.” “According to our calculations, tax relief and tax burdens only begin to roughly balance each other out from an interest rate level of just under three per cent. However, it is difficult to estimate the chances of success of the proposed reform at the ballot box. Even though homeowners are clearly in the minority in Switzerland, our analyses show that their political participation in the past was significantly higher than the average voter turnout of the Swiss population,” says Hasenmaile.

The Raiffeisen report also comments on the declining mobility of tenants.

Lack of supply discourages relocation

The persistent housing shortage is leaving its mark on the behaviour of the Swiss population, writes the bank. Because suitable properties are hard to find and market rents are rising rapidly, many tenant households are being forced to make major compromises. This manifests itself in significant relocations to peripheral communities or even in not moving at all. The number of people moving within Switzerland each year has fallen by 74,000 since 2020. These behavioural adjustments, as well as somewhat weaker immigration recently, have slowed the shortage of housing supply somewhat.

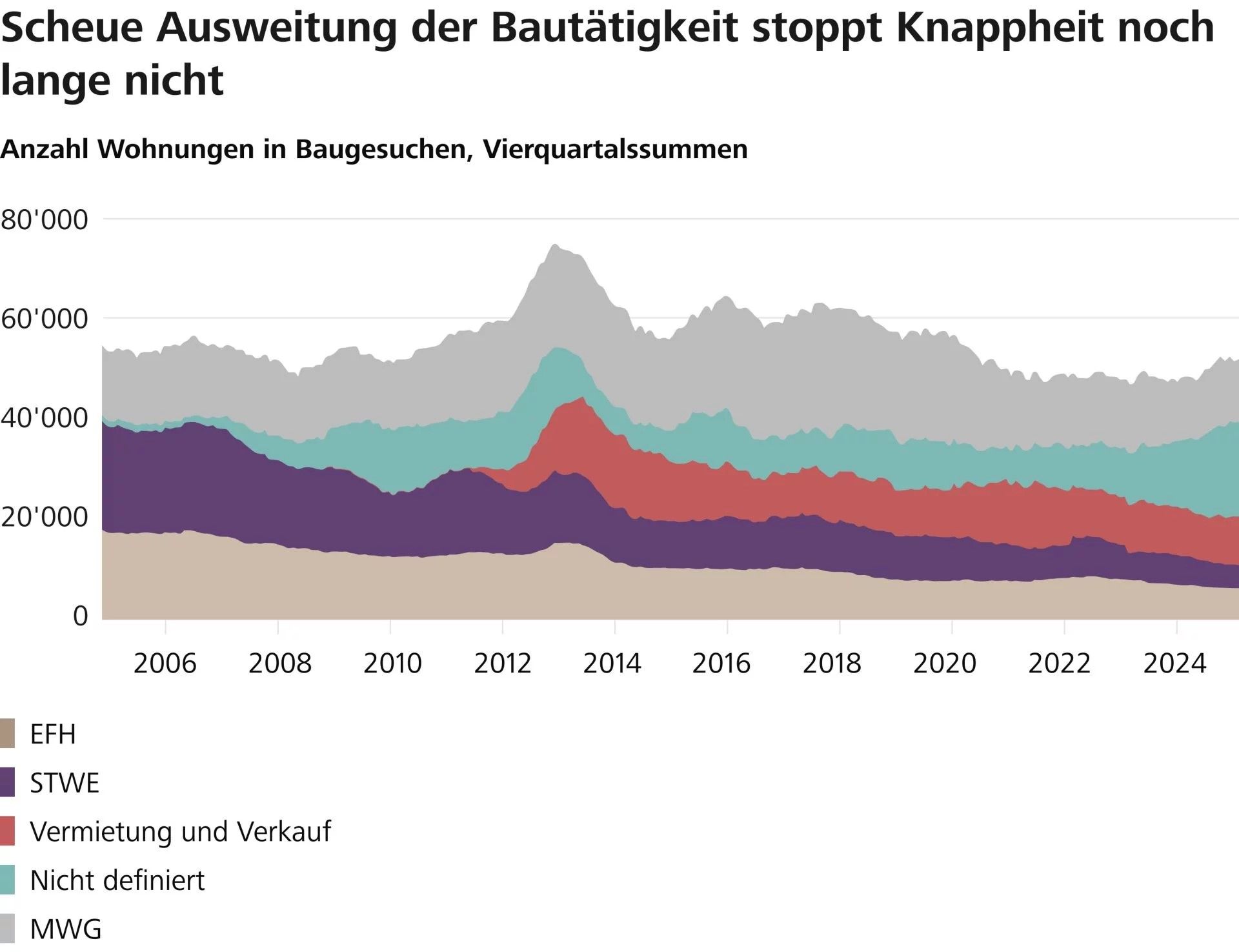

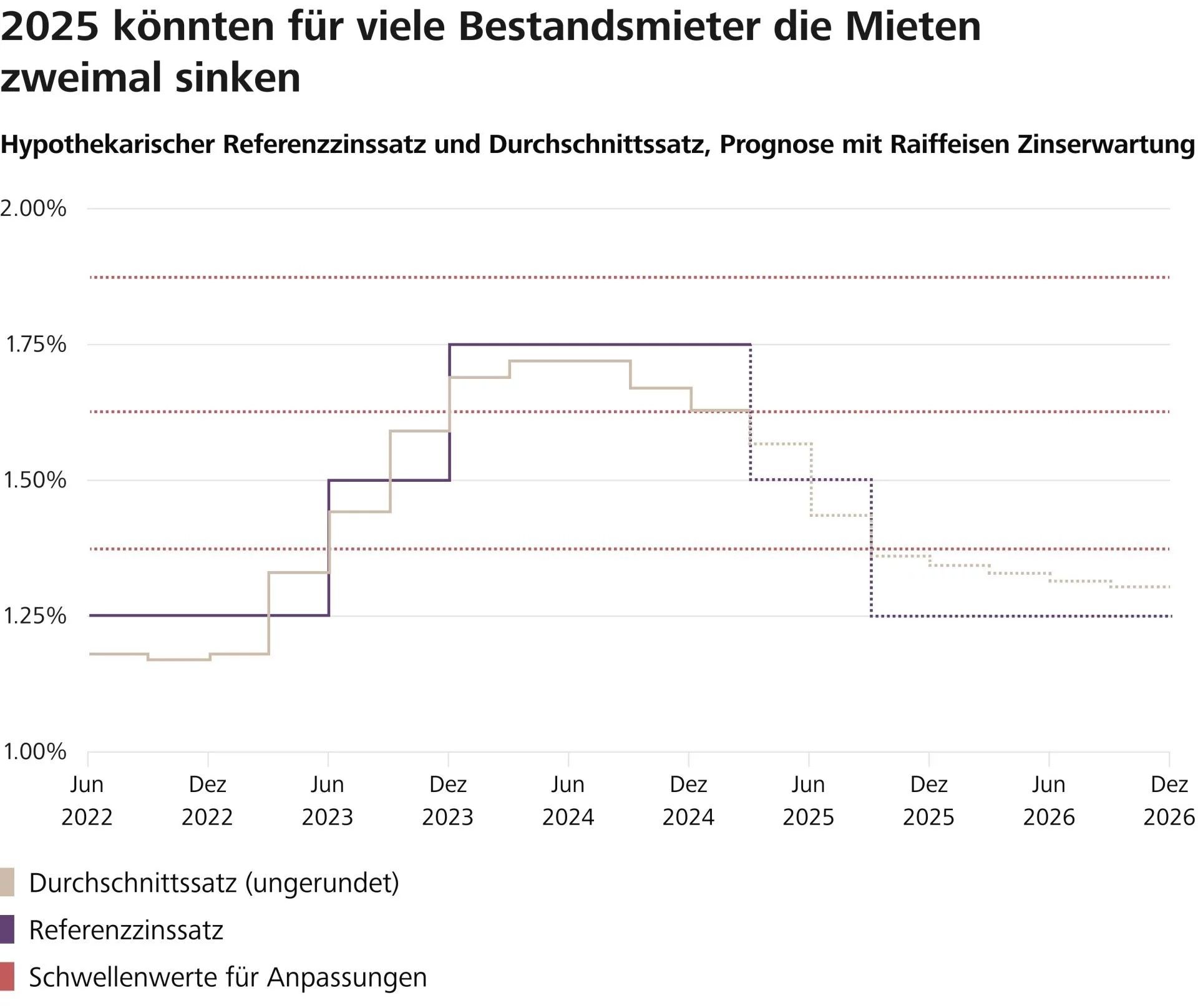

At the same time, the first signs of impetus from the construction sector were recognisable. In 2024, the number of flats for which a planning application was submitted rose by eight per cent. “However, this increase is no more than a drop in the ocean. Because even an increase in actual construction activity of this magnitude would not be enough to make up for the deficit between new households and newly built flats that has arisen over the past three years,” explains Fredy Hasenmaile. As long as construction activity does not increase more strongly and the rental market does not reach equilibrium, the housing cost burden on tenants will continue to increase in the long term. In the short term, however, two reductions in the reference interest rate expected by the end of the year will at least provide some relief for existing tenants.

Rising demand for residential property again

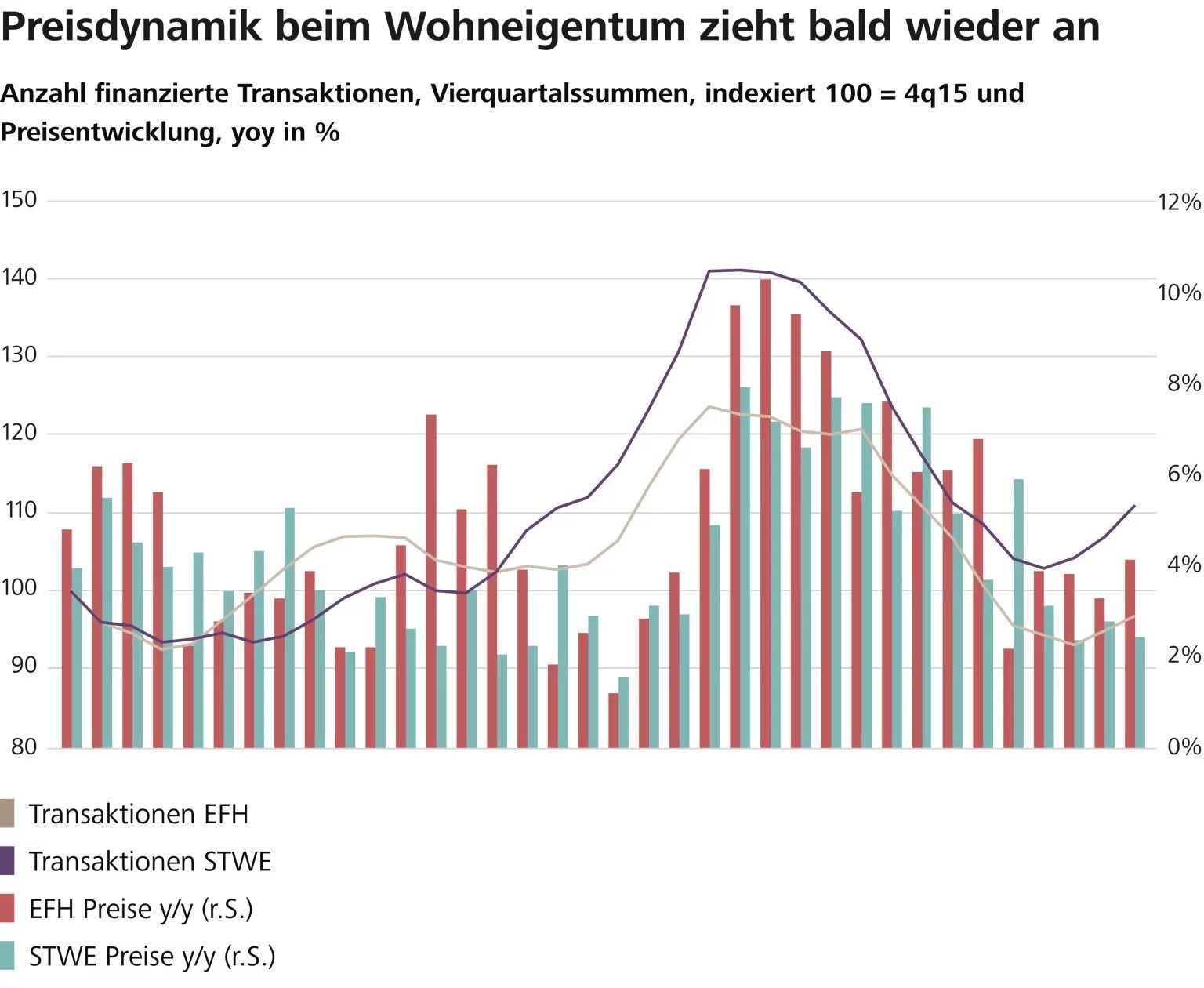

Raiffeisen sees a noticeable rise in market prices on the owner-occupied property market. The latest interest rate cuts have further increased the housing cost advantage of home ownership. Using the example of a typical four-room flat, the bank’s calculations show a saving of 17 per cent compared to renting. Savings of up to 30 per cent can be expected over the course of the year thanks to a further fall in interest rates. Demand for home ownership has therefore picked up noticeably.

Hasenmeile can be quoted as follows: ‘The significant slowdown in price momentum until mid-2024 is already accelerating again. This means that the cooling of the property market caused by the post-Covid rise in interest rates has come to an end. The signs point to a brilliant change of direction.

Here you can download the entire report “Immobilien Schweiz – 1Q 2025; Was, wenn der Eigenmietwert fällt?” by Raiffeisen as a PDF.