UBS interest rate forecast and trend.

06.02.2025The US president and his announcements have led to major turbulence in recent days, including on the equity and financial markets. The current UBS interest rate forecast also addresses this. However, it also provides an overview of the current interest rate environment, the long-term expectations for interest rate trends and the relationship between the SNB’s key interest rates and mortgage rates.

With a current key interest rate of 0.5 per cent, Switzerland is in an environment of slightly expansionary monetary policy. After a prolonged period of sharply falling interest rates through to negative interest rates in 2022, the key interest rate temporarily rose to 1.75 per cent in 2023 to combat rising inflation as a result of the coronavirus pandemic and the Russian attack on Ukraine.

UBS diagnoses high volatility due to Trump’s policies

Yields on Swiss government bonds and mortgage interest rates rose again in January after falling significantly last year. Robust data on the US economy had strengthened market expectations that the US central bank would lower its key interest rates only slightly or not at all this year. This has led to a significant rise in US yields and, as a result, also in Swiss yields.

In addition to the robust US data, the inauguration of the new US government has also caused interest rates to rise. With his promise of lower taxes and new tariffs, Donald Trump stands for a trend towards higher interest rates. However, it is still difficult to predict how Trump will actually organise the US tariffs. According to UBS, comprehensive tariffs could plunge the global economy into a recession and cause interest rates to fall.

The bank writes on its website: “Donald Trump’s trade policy should lead to more volatility on the bond market, but not herald a trend reversal. We therefore expect yields on Swiss government bonds and mortgage rates to continue their sideways trend. Mortgage rates linked to SARON are likely to benefit from a further interest rate cut by the Swiss National Bank.”

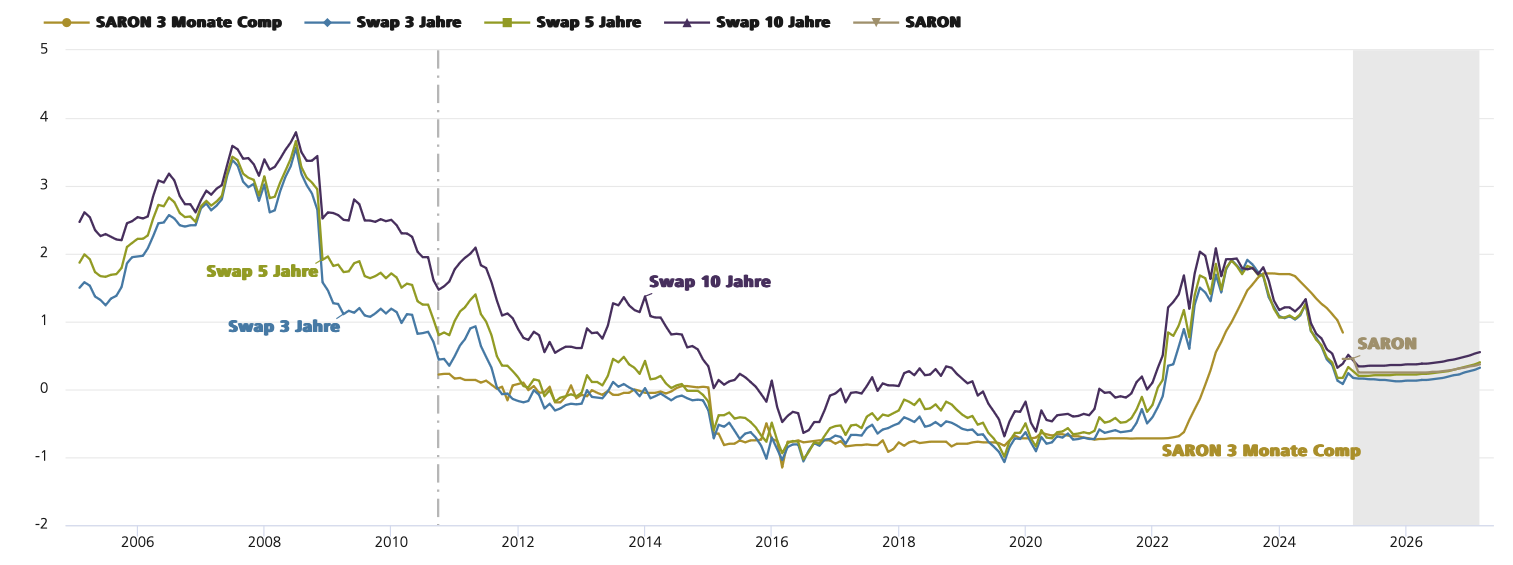

Long-term interest rate development in per cent

Despite the high volatility on the markets, UBS still sees a fairly stable development for the interest rate landscape in Switzerland in its forecast. Experience shows that interest rates fluctuate strongly over time, as they are influenced by numerous factors in addition to the behaviour of the SNB – not least how the financial markets price in their interest rate expectations.

Key interest rate and mortgage rate are closely linked

For homeowners, the mortgage interest rate is one of the most important factors when choosing or extending a mortgage. It is decisive for the monthly costs of a property.

The level of mortgage interest rates in Switzerland depends on various factors. For example

- the key interest rate of the Swiss National Bank

- the refinancing costs of the banks

- the development of inflation

- the development of the economy

- market expectations

- and the influence of US Federal Reserve policy.

How to choose the right interest model

Which mortgage is right for you naturally depends on your own preferences. Some people simply want to know how much the mortgage will cost in the long term, while others would like the most favourable solution and are prepared to take a certain amount of risk.

Nevertheless, there are also quite rational arguments in favour of or against the possible models, because not every strategy is equally suitable for every economic situation and depends, among other things, on the current interest rate situation and the expected interest rate trend.

UBS writes: “The interest rate expectation helps to create scenarios for the amount of your future financial burden. The table below provides an initial indication of which type of mortgage might be suitable at the current interest rate level.”

The following table shows clearly at which interest rate level which form of mortgage is more or less suitable from an economic point of view: