UBS sees positive prospects for Saron mortgages.

07.03.2024In its latest interest rate forecast and trend for mortgages, UBS writes that the volatile interest rate situation has calmed down after a phase of interest rate hikes. Inflation rose significantly in 2022 and peaked at 3.5 percent. The Swiss National Bank (SNB) then raised the key interest rate five times in succession, most recently to 1.75 percent. Thanks to these measures, inflation has fallen significantly in recent months and is now below the two percent mark. This corresponds to the SNB’s definition of price stability.

Accordingly, the SNB refrained from raising the key interest rate again in December 2023. If the SNB’s forecast is confirmed and inflation remains within the target range in the coming months, the first interest rate cuts can be expected in the course of 2024, the bank writes.

As justification for its expectation, the bank writes in its forecast: “Yields on Swiss government bonds and mortgage rates had fallen significantly by the end of December 2023, moved slightly higher again in the first half of January and have since moved sideways.

The next important point of reference for the markets will be the monetary policy assessment by the Swiss National Bank (SNB) on March 21. We assume that the SNB will still refrain from cutting interest rates in March and will only reduce the key interest rate for the first time in the second quarter, together with the European Central Bank and the US Federal Reserve. Overall, we expect three interest rate cuts in Switzerland this year. This should reduce the key interest rate from a level of 1.75 percent to 1 percent.

In January, Swiss inflation was significantly weaker than expected. There is therefore the possibility of a rate cut in March if inflation in February is also unexpectedly low and the Swiss franc tends to strengthen.

The capital market has already prepared itself for a series of interest rate cuts in 2024, which is why we see only a slight decline in longer-term Swiss government bond yields or longer-term mortgage rates in the coming quarters. Mortgage rates linked to SARON, on the other hand, are likely to benefit significantly from the SNB’s interest rate cuts in the coming quarters, as the SARON rate is closely linked to the SNB’s key interest rate.”

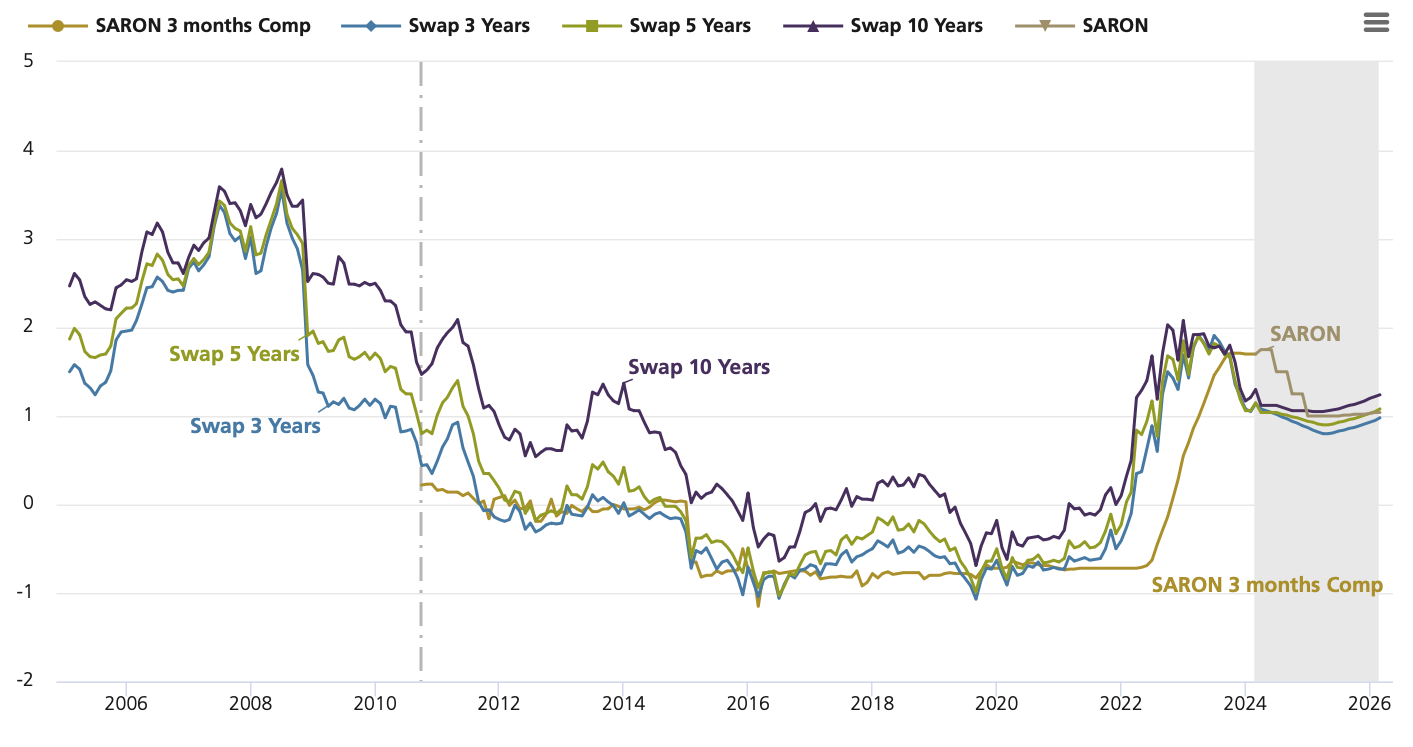

Long-term interest rate development in percent

Interest rates fluctuate repeatedly over the course of time. This can be due to a variety of factors. The last trend reversal occurred in 2022 and was marked by the following events:

- In response to strong inflation following the pandemic and Russia’s war in Ukraine, the SNB – like other central banks – began raising its key interest rate in 2022. As a result, yields rose sharply.

- To curb higher levels of inflation, the SNB continued to raise key interest rates in 2023 while yields remained high. Towards the end of 2023, inflation eased significantly, causing yields to fall sharply in anticipation of future rate cuts.

- Today’s yields already reflect (anticipated) rate cuts in 2024. Therefore, the potential for a further fall in the current year is very limited. If inflation or growth turn out to be stronger than expected, yields could even rise again