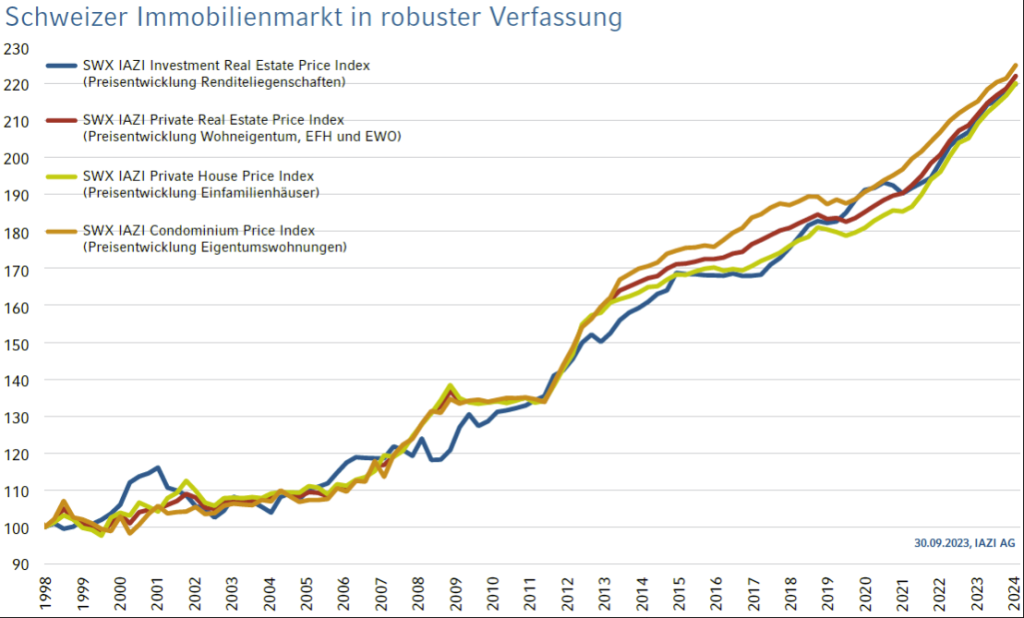

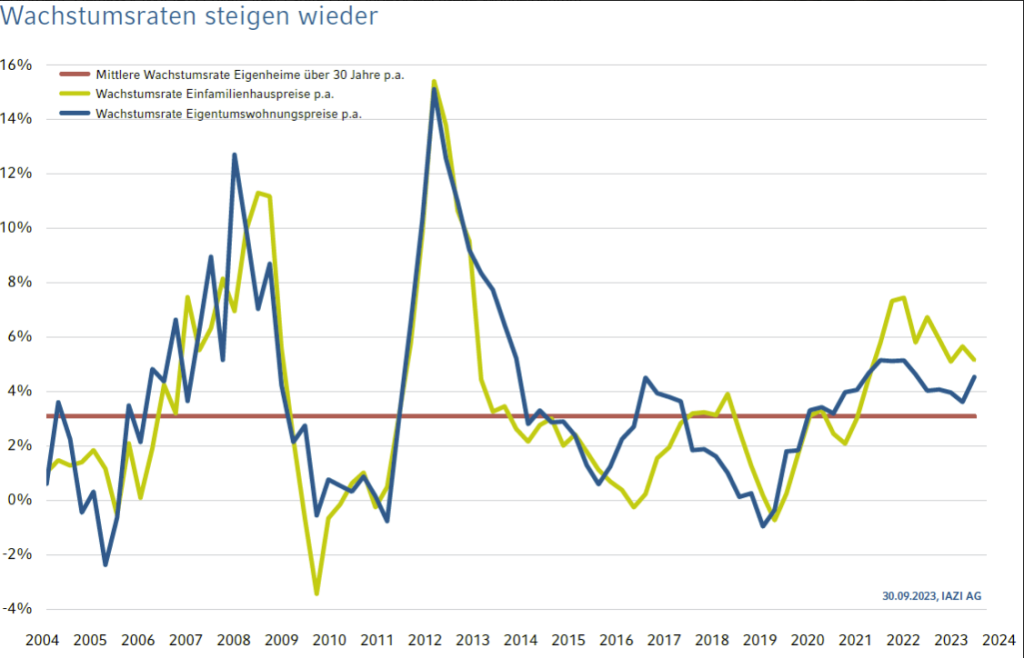

According to IAZI AG, the Swiss real estate market shows no signs of weakness in the 3rd quarter of the current year. The evaluation of current freehold transactions shows that the willingness to pay for houses and flats has risen again, the company writes in its media release. And further: “According to the SWX IAZI Private Real Estate Price Index, residential property changed hands at 1.5% higher values than in the previous quarter. Single-family houses (+1.5 %) and owner-occupied flats (+1.6 %) posted practically the same growth rates. Over the last twelve months, the price increase for owner-occupied homes thus adds up to an impressive 4.9 %.”

According to IAZI AG, slightly higher transaction prices were also recorded in the investment property segment; the values of residential investment properties rose by 0.6 % in the third quarter of 2023. Within a twelve-month period, the increase was 4.3 %.

It can be assumed that numerous potential buyers as well as sellers are currently in a waiting position: Prospective buyers are postponing their purchase intentions in the hope of future price reductions, while sellers are exercising patience in order to realise sales at the current high price level. IAZI writes: “An indication of this is the number of reported transactions, which is currently significantly below the level of previous years. However, those changes in ownership that do take place and are therefore included in the calculation of the price indices were concluded at higher prices and raise the index. Conversely, all those transactions that have not (yet) been concluded due to differing price expectations are not included.

Especially in the segment of multi-family houses financed with borrowed capital, the additional interest-related costs could also be cushioned by rent increases. This applies to both new leases (asking rents) and existing leases (existing rents). A further increase of the reference interest rate to 1.75% as of December 2023 is also considered certain, which allows for a further rent increase of 3% depending on the situation. In addition, part of the inflation and the general cost increase may be passed on to the rents, which also strengthens the income side and supports the attractiveness of real estate investments.

Watch the market commentary by Donato Scognamiglio, CEO of IAZI AG, on YouTube here:

The media release goes on to say: “The vacancy survey by the Federal Statistical Office also shows that the demand pressure and thus the rental potential remain high: Switzerland-wide, only around 1.2 % of flats were vacant as of 1 June 2023; in many highly populated regions, the rate is significantly lower. This is unlikely to change much, as demand will remain high due to strong immigration: according to data from the State Secretariat for Migration, by the end of August 2023 there were already 60,000 net new residents, which is roughly equivalent to the resident population of the city of Lugano. This alone generates a demand for around 30,000 additional residential units. By the end of the year, this number is likely to grow significantly.

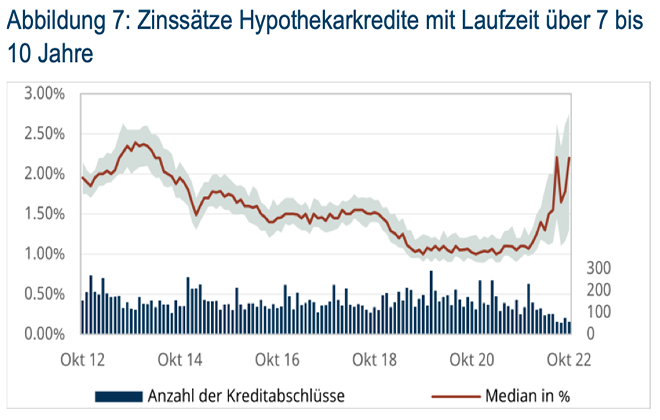

The temporary interruption of interest rate hikes also has a positive influence on the real estate market. With its decision in September, the Swiss National Bank is leaving the key interest rate at 1.75 % for the time being. The interest rate level for fixed mortgages should thus settle in the range between 2.5 % and 3 %, with money market mortgages (SARON) also approaching this range.”