IAZI AG expects the super cycle of rising prices in the private residential property sector to slowly turn into a soft landing, as its Chairman of the Board of Directors Donato Scognamiglio reported at the media conference on 14 November. The signs of a slowdown are becoming more pronounced and the number of open-market transactions has fallen steadily since 2021, while the number of new mortgage transactions has fallen by around a quarter since 2021.

After the long period of low interest rates, central banks in Europe have returned to their traditional instruments since 2022. In order to combat inflation, they have raised key interest rates in individual steps. The rise in interest rates to date has not left the European property markets unscathed: Transaction prices for residential property have fallen by -9.9% over the last twelve months in Germany, for example. Interestingly, however, prices for residential property in Switzerland have risen by 4.9% in the same period. This development, which differs from other countries, can be partly explained by the favourable economic environment. At 1.7%, inflation is within the range defined by the Swiss National Bank (SNB). Measured in terms of gross domestic product (GDP), the local economy is recording moderate but still positive growth of 1.3%. There is still full employment with an unemployment rate of 2.0% as at September. On the other hand, there are still no signs of a seller’s market in view of the low liquidity or the low number of transactions. Anyone who owns a home and wants to sell can wait. The current interest rates of around 3% are still acceptable and are not forcing anyone to sell their own four walls.

IAZI sees the end of the super cycle approaching

In the area of private residential property in particular, however, the super cycle of rising prices is likely to slowly turn into a soft landing, writes IAZI AG in its press release. This is because the signs of a slowdown are firming up. For example, the number of open market transactions for private residential property has fallen by around 40 per cent from its peak in 2021, when the Covid pandemic triggered an unexpected boom in the housing market, to 2023.

In central Switzerland, Espace Mittelland, eastern and south-eastern Switzerland, parts of Ticino and parts of French-speaking Switzerland, the number of private property transactions fell by 10 to 40 per cent in one year. At the same time, properties have been advertised on the platforms for longer. High offer rates for single-family homes of 3 per cent and more can be found primarily in French-speaking Switzerland, Ticino and the Jura. Only in Zurich, around Lake Zurich and in parts of Central Switzerland there is still a shortage of advertised detached houses; here the rate is less than 1 per cent. The supply of condominiums is much tighter. Given the current rise in interest rates, smaller properties or even rental flats are more in demand.

More than 3 million Swiss Francs for a detached house in the canton of Zurich

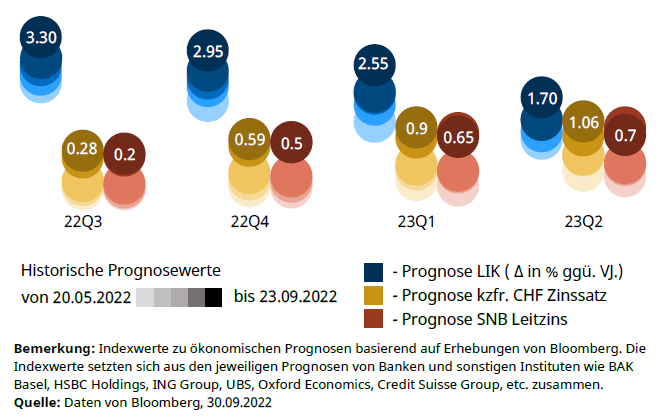

Another sign that the price growth boom is coming to an end: new mortgages for private households have fallen by around a quarter since last year’s peak. While households have been able to benefit from the favourable Saron mortgages compared to fixed-rate mortgages in recent years, the sharp rise in the Saron has now eroded this supposed advantage. The market is expecting a breather on the interest rate front. This is because the current Saron rate is now very close to the mortgage rate for 10-year fixed-rate mortgages. However, the slowdown is taking place at a very high property price level.

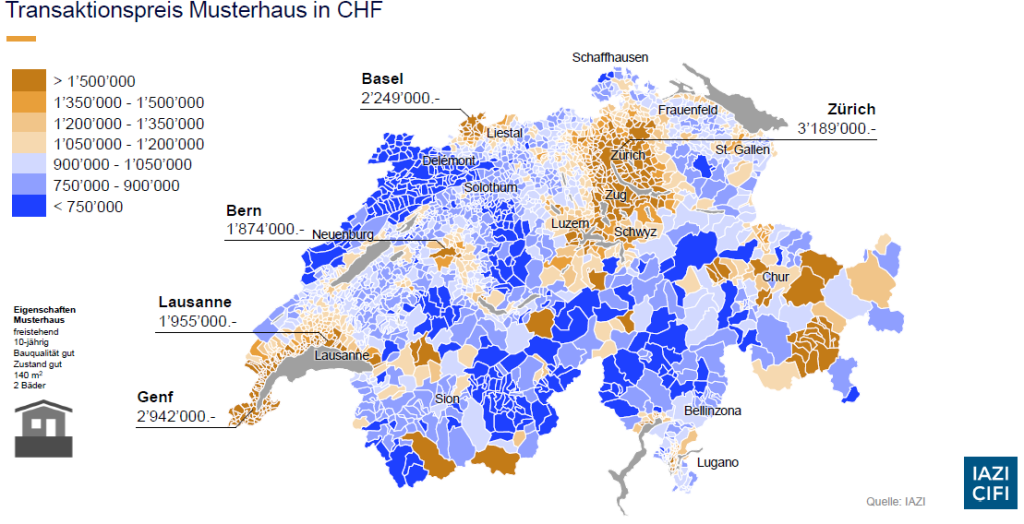

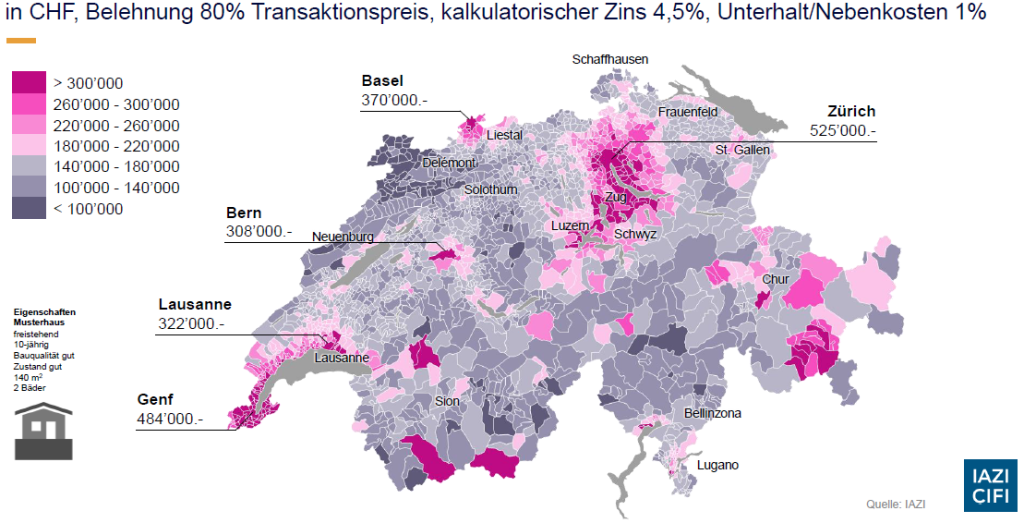

A typical detached house in the canton of Zurich currently costs over 3 million; in the canton of Geneva it costs just under 3 million. In order to fulfil the affordability guidelines, a household would have to earn more than CHF 400,000 and contribute an additional CHF 600,000 of equity. (see charts 1 & 2).

Chart 1: This is how much a typical detached house costs

Transaction price for a typical home in CHF, Source: IAZI

Chart 2: This is how much income is needed for a detached house

Necessary household income in CHF with a loan-to-value ratio of 80 per cent of the transaction price, an imputed interest rate of 4.5 % and maintenance and auxiliary costs of 1 % (Swiss National Bank guidelines); Source: IAZI

Tenants also have to recalculate their budgets

As the price boom for private residential property slowly crumbles, tenants are generally faced with higher prices. Advertised asking rents have risen in many cantons over the last five years. The frontrunners are Zug (+9.5%), Zurich (+6.3%) and Bern (+4.7%). The average increase in rents in Switzerland is +4.4%. While existing rents benefited from rent reductions during the low-interest phase, the tide has now turned in the wake of the interest rate turnaround. The mortgage reference interest rate rose from 1.25 to 1.50 percent on 1 June 2023, which gives landlords the right to increase rents, provided they have also implemented the rent reductions. In addition, 40 per cent of inflation and annual cost lump sums of around 0.5 per cent can be passed on to tenants. If the interest rate is increased to 1.75% on 1 December, as many market participants expect, many tenants will have to recalculate their budgets for 2024.

Immigration: a lot of growth for a small country

Switzerland has grown by 37 per cent in the last forty years, writes IAZI. Since 2000, the population has grown by 23%. Compared to our neighbouring countries such as Germany (+2.7%), Italy (+3.4%) or the EU average of +4.6%, Switzerland occupies a top position. However, Switzerland is not only growing by its own efforts. Since 2001, the share of immigration in population growth has always been greater than the birth surplus. Switzerland is now rejuvenating itself with international immigration. Those who want to build a new future in our country are mostly Europeans; around 40% of immigrants are educated in the service sector, with middle and senior managers earning slightly more than their Swiss peers.

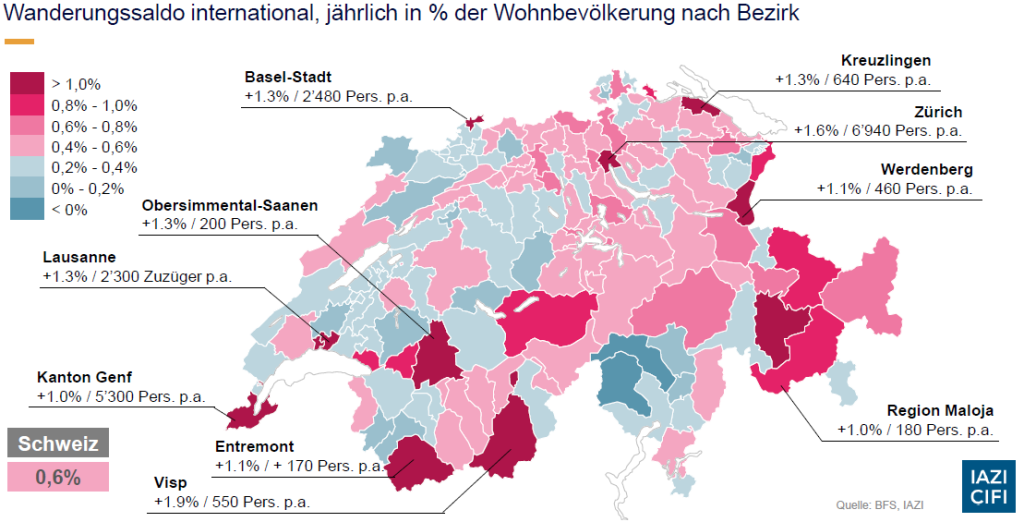

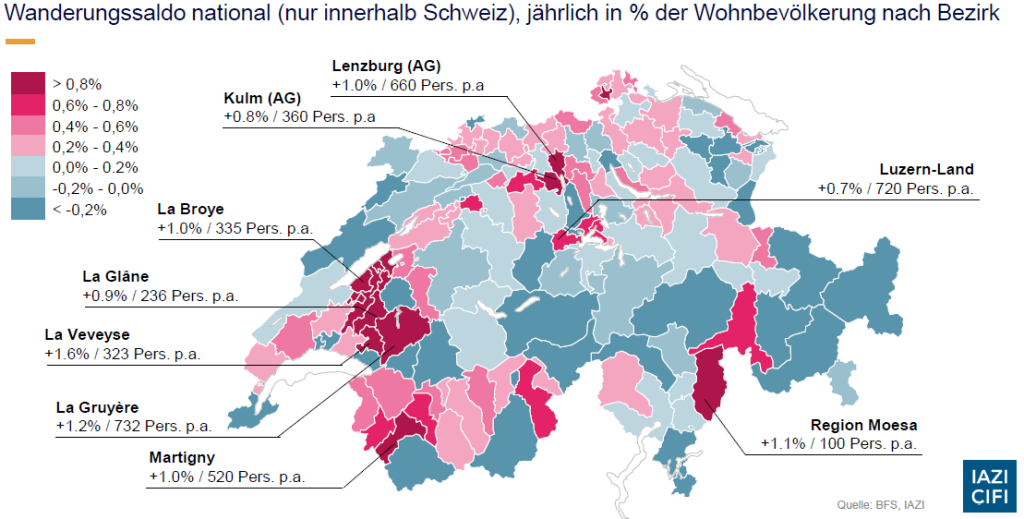

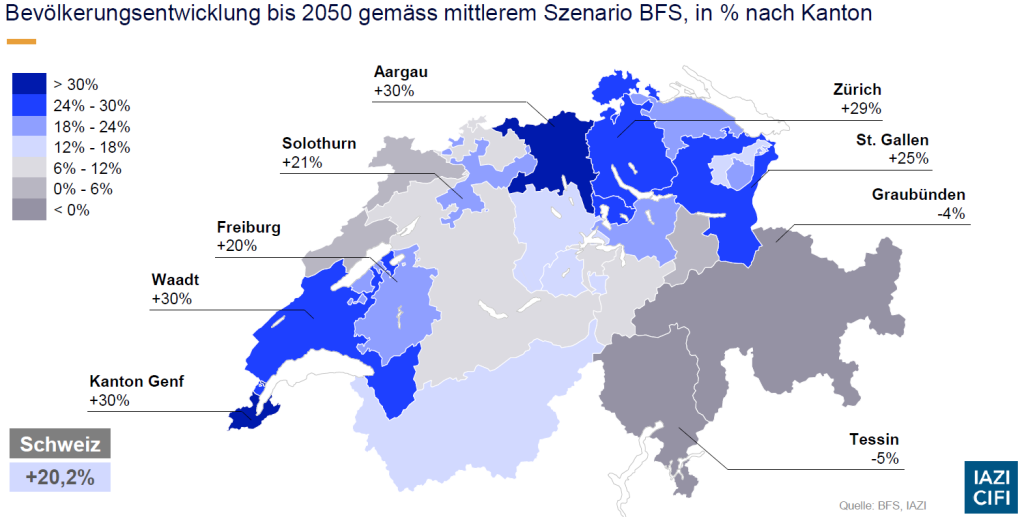

The most important questions in this context are where these people will live and how the face of Switzerland will change as a result. Looking at the districts of Switzerland with an international migration balance of more than 1 per cent, newcomers are mainly settling in Geneva, Zurich and Basel, but also in the tourist cantons of Bern, Graubünden and Valais. (see slide no. 3). Residents, on the other hand, move to the agglomeration districts around Zurich, Geneva and Lausanne (see slide no. 4). In the FSO’s 2050 population scenario, which still anticipates a population increase of around +20%, the population will grow primarily in the Zurich metropolitan area and in the cantons of Vaud and Geneva. At the same time, the population in Graubünden and Ticino will stagnate (see Slide No. 5). A special challenge for the future will be that the population will not always grow where there are still enough construction zones. Strategies are needed here that go beyond the buzzword of densification.

Chart 3: Where newcomers from abroad are moving to

International net migration, annually as a percentage of the resident population by district; Source: Bundesamt für Statistik, IAZI

Chart 4: Residents move to the periphery

National net migration (only within Switzerland), annually as a percentage of the resident population by district; Source: Bundesamt für Statistik, IAZI

Chart 5: Where people are going to live in Switzerland

Population development up to 2050 according to the medium scenario (Federal Statistical Office), in per cent by canton; Source: Bundesamt für Statistik, IAZI