Property investment still on the upswing.

25.03.2025According to the latest results of the Swiss Property Benchmark published by property consultancy IAZI AG, the Swiss property market showed a clear recovery in 2024. Following the interest rate-related decline in the previous year, Swiss property investments recovered again last year. Residential property in particular benefited from high demand and recorded a visible increase in value, writes the company. Rents for residential property also rose more sharply in 2024 than they have for 20 years, which is attributable to the increases in the refinancing interest rate, rising costs and high demand. Meanwhile, the vacancy rate remains stable at a low level. This is a clear sign that Swiss property remains a sought-after investment, especially in times of global uncertainty.

Market for direct property investments has recovered

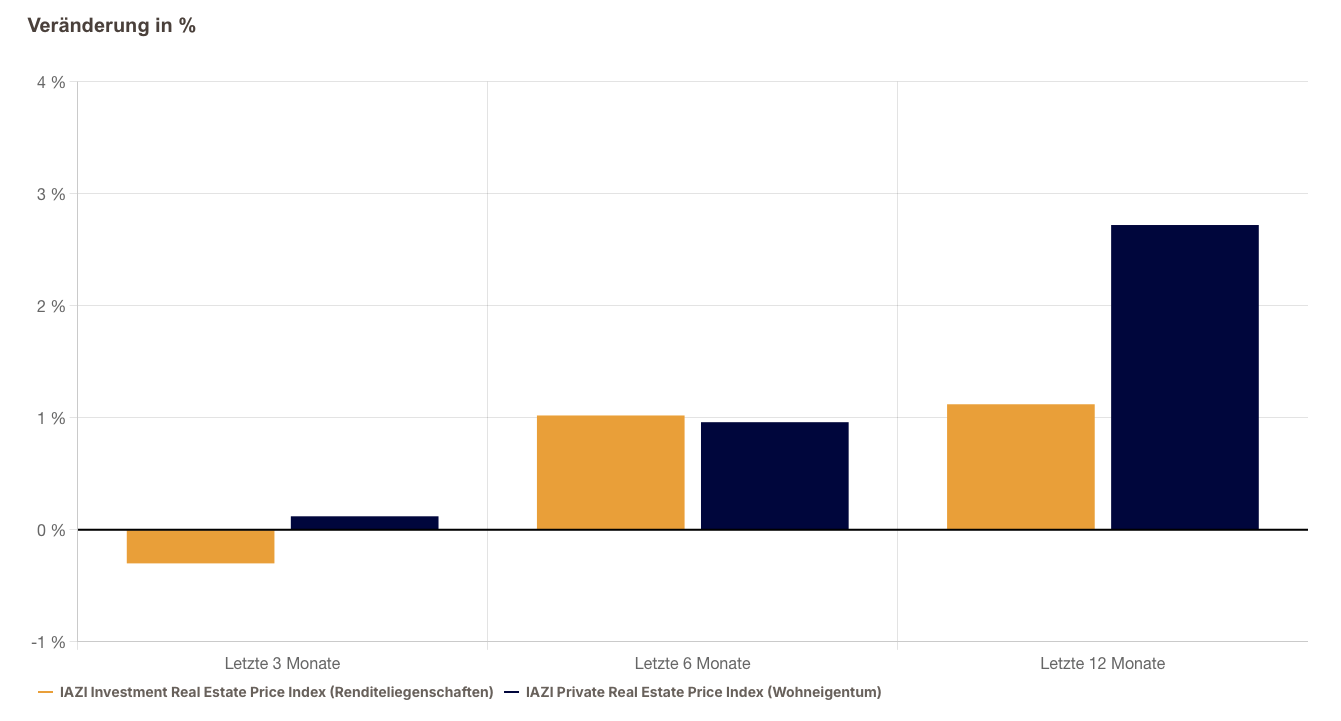

IAZI writes: “After an interest rate-related dip in the previous year, Swiss property investments became significantly more attractive again in 2024. However, the picture differs depending on the type of use: While residential properties recorded a visible increase in value of 2.5% on average across Switzerland in 2024 (2023: 0.1%), a renewed, albeit minimal, value correction of -0.1% was observed for office and commercial space (2023: -1.5%).”

Residential rents rise sharply

The rents measured in the Swiss Property Benchmark represent the typical, average tenancy, writes IAZI. The property portfolios analysed include both newly let flats and properties without a change of tenant. The development of rental prices therefore depends on market demand (offers/new tenants) as well as on factors relevant to tenancy law such as the reference interest rate, inflation and general cost increases. These typical rents and their development are therefore based on different data than the supply or market rents based on rental offers advertised in adverts.

At +4.5% (median), the data on ‘typical rents’ for residential properties showed by far the strongest increase in the past 20 years in 2024 (2023: +2.4%). One of the reasons for this was the two increases in the reference interest rate, which came into effect with the usual delay in 2024. At the same time, price equalisation and general cost increases under tenancy law had an impact on existing tenancies. IAZI writes that asking prices for new lettings were also significantly increased in 2024. In combination, these factors led to the sharp increase in rents observed in 2024.

Office and commercial space also recorded higher rental income of +2.9% (median) in 2024; the increase in the previous year was somewhat lower at +2.7%.

Vacancy rate stable at a low level

According to the IAZI, the vacancy rate, measured as the financial ratio of unrealised rent as a percentage of the target rent, remains stable at a low level. As in the previous year, the average vacancy rate for residential space in 2024 was 2.2%. In the city of Zurich (1.5%), the vacancy rate is below the national average, while Lausanne (2.1%) and Bern (2.1%) are in line with the national average; Geneva (2.3%) and Basel (3.3%) have slightly higher rates. Office and commercial space showed an average unrealised rent of 5.8% in 2024 (2023: 5.9%), continuing the downward trend that has been ongoing for several years.

Market conditions remain volatile

The pleasing developments for direct property investments last year benefited from falling interest rates, strong demand for space and solid economic development. Residential space in particular was once again characterised by a significant appreciation, following a trend that had been interrupted in 2023 by the temporary rise in interest rates. Owners of office and commercial space can also look back on a positive year compared to 2023, although caution is being signalled with regard to the minimal devaluation.

However, the future is uncertain in view of the economic and security policy challenges and the potentially sharp rise in government spending and debt. However, the Swiss National Bank’s decision to cut short-term interest rates again from 0.5% to 0.25% is a positive signal.

IAZI’s conclusion is therefore a cautious one: “In times of heightened global uncertainty, property in the previously ‘safe’ haven of Switzerland was a sought-after investment.”

About IAZI Swiss Property Benchmark®

The Swiss Property Benchmark compiled by the real estate consultancy IAZI is the largest and most representative data pool for direct real estate investments in Switzerland. Since 1994, it has been based on over 15,000 properties with a market value of around 300 billion Swiss francs. For 2024, the IAZI AG analysed a total of 7,400 properties with a market value of over 180 billion Swiss francs. In terms of market value, 49% of the properties are residential properties, comprising around 200,000 rental apartments throughout Switzerland, 22% are mixed-use properties and 29% are office and commercial properties.