According to the current UBS interest rate forecast, inflation in Switzerland is finally easing. The summer brought stability to the mortgage market, as mortgage rates and government bond yields were stable in July, as they had been in the previous month.

The bank writes “For a long time, the inflation figures were stronger than expected, but now the trend seems to be turning around. In Switzerland, inflation in June fell below the 2 per cent mark, which the SNB defines as the upper limit of its inflation target, for the first time since January 2022. Inflation rates have also fallen more than expected in the US and the UK.”

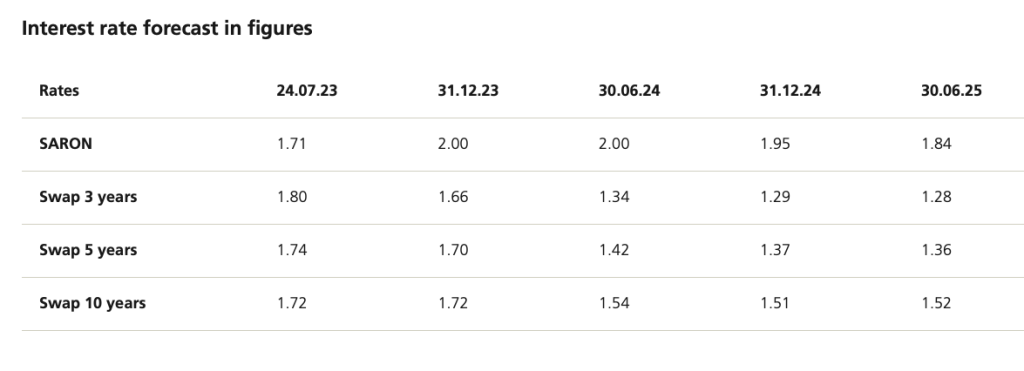

According to UBS expectations, the outlook for possible key interest rate cuts in the second half of the year should lead to slightly lower interest rates, especially for mortgage rates.

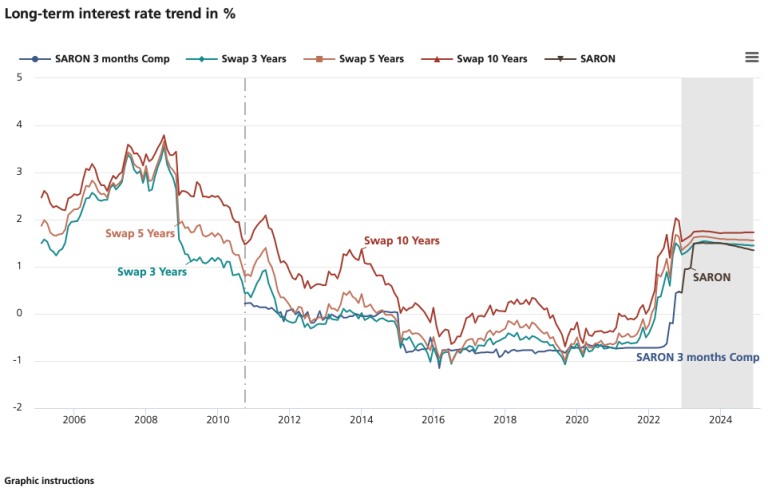

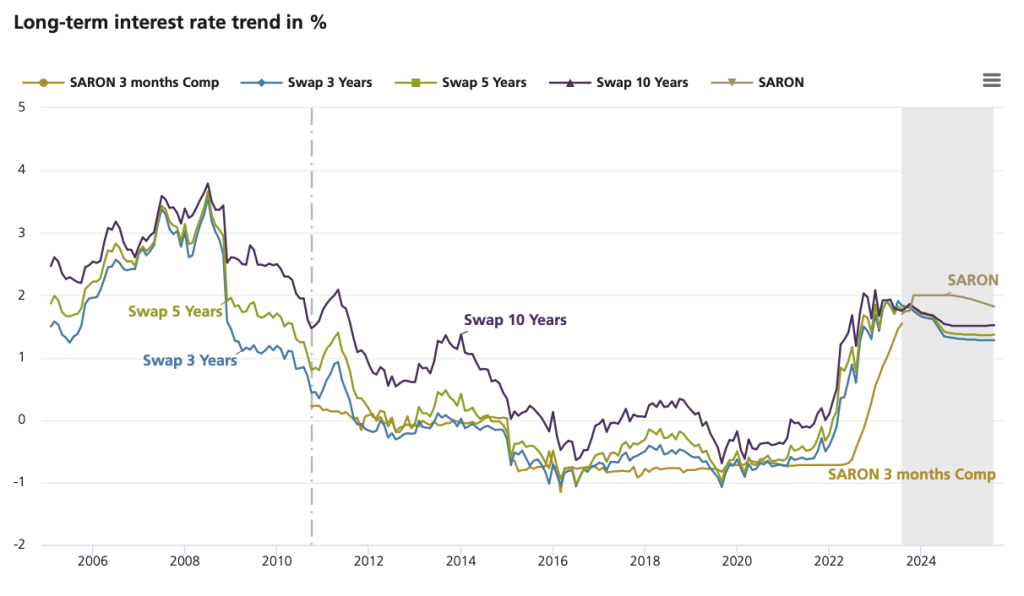

Sources: Bloomberg, UBS Switzerland AG: Rates through the end of 2010 are based on Libor, and on SARON from 2011. The effective interest rate of the product is calculated using the margin + compounded SARON of the accounting period. When calculating the interest rate, the compounded SARON can never be less than zero.

Sources: Bloomberg,UBS Switzerland AG

Please note that the stated interest rate is in part a forecast and the actual interest may be higher or lower.

In its “Interest Rate Market Assessment”, avobis also notes with satisfaction that the inflation data for July published at the beginning of August show a continuation of the item trend of recent months. In particular, the decline in imported inflation should be emphasised as a positive sign. At 1.61% on an annual basis, the inflation rate remains below the SNB’s inflation target. Nevertheless, the risks of multi-round effects, mainly due to the increase in rents, are still present and not yet fully captured in the latest data. As a result, the interest rate market reacted to the inflation data with slightly higher swap rates, while the orientation for the next monetary policy assessment remained constant.

The avobis forecast for the key interest rate does not assume an increase above 2.0% despite the current development. If the positive inflation trend continues, a further reduction in long-term interest rates would be possible. However, it is unlikely that the 10-year swap rate will fall significantly below the SARON rate in the longer term. In the event of a negative inflation trend, however, the yield curve could continue to fluctuate strongly.