The “SWX IAZI Private Real Estate Price Index” for private residential property (single-family houses and condominiums) reaches an increase of 1.2% in Q3 2021 (previous quarter: 1.7%). On an annual basis, price growth amounts to 5.5% (previous quarter: 4.6%). “The price trend for residential property is continuing at full steam. Especially in times of crisis, real estate remains a highly sought-after investment,” says Donato Scognamiglio, CEO of IAZI AG. On the other hand, those who had invested in financial stocks probably had to accept losses in these months. The reason for this is inflation concerns and the turbulence surrounding the stumbled Chinese real estate giant Evergrande. “Fortunately, at the moment it looks like Evergrande is classified as ‘too big to fail’ in China,” says Donato Scognamiglio. So the negative shock waves would not spill over to the global financial markets for the time being.

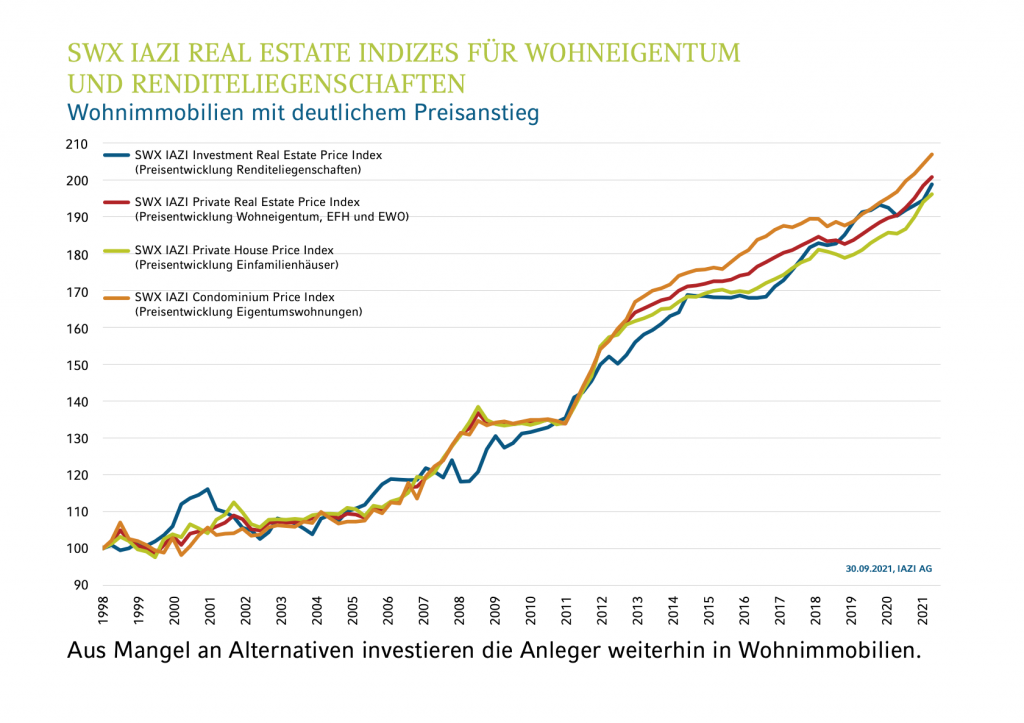

According to the IAZI indices, property prices in all segments have risen by around double since 1998. Source: IAZI AG

Transaction prices for private residential property

Single-family houses reached a price growth of 1.1% in the 3rd quarter (previous quarter: 2.2%). On an annual basis, the growth amounts to 5.8% (previous quarter: 4.5%). In the index, this is the highest annual growth since the beginning of 2013. Condominiums recorded price growth of 1.3% in the 3rd quarter (previous quarter: 1.3%). On an annual basis, growth is 5.1% (previous quarter: 4.7%). This is the highest annual growth since the beginning of 2014.

National Bank sends contradictory signals

In connection with the extraordinary price developments on the real estate market, the SNB Deputy Director warned in late summer of possible price corrections or loan defaults. In the event of an abrupt rise in interest rates, considerable losses are to be expected, according to the SNB. In more drastic terms: real estate crisis of the 1990s reloaded. “However, here the left hand is warning against the heat that the right hand is fanning,” says Donato Scognamiglio. It is precisely the record low interest rates that make residential properties so desirable for investors, small investors or private individuals. They ensure record-low mortgage rates and inspire the dreams of future homeowners. But the SNB does not want to raise the key interest rates yet. “So it is becoming part of the real estate bubble itself,” says Scognamiglio. “It warns, but it does not help”.

Transaction prices for apartment buildings

In the 3rd quarter, price growth for multi-family houses reached 2.2% (previous quarter: 0.7%). On an annual basis, price growth increased significantly to 4.5% (previous quarter: 1.1%). It is now clear that this segment is returning to the “pre-Corona” trend. In Q3 2019, price growth was 4.9% on an annual basis; a year later, it had fallen to -0.5%.

“After a little cooling, the earlier heat has returned and the situation is back to the old: For lack of alternatives, investors continue to invest in apartment buildings,” says Donato Scognamiglio. But what makes him very critical, he says, is the fact that many private individuals now also want to buy an income property and are participating in the bidding process when properties are sold. “Especially when yields are very low, this entails high risks for private individuals”. The more overheated the price development of residential property becomes, the higher the drop. “Apparently, many have forgotten in the times of cheap money and the constantly growing price curve that prices can also fall sometimes.”

Watch the market commentary by Prof. Dr. Donato Scognamiglio, CEO of IAZI AG, in the video here: