IAZI: Real estate remains a good Investment with growth signs.

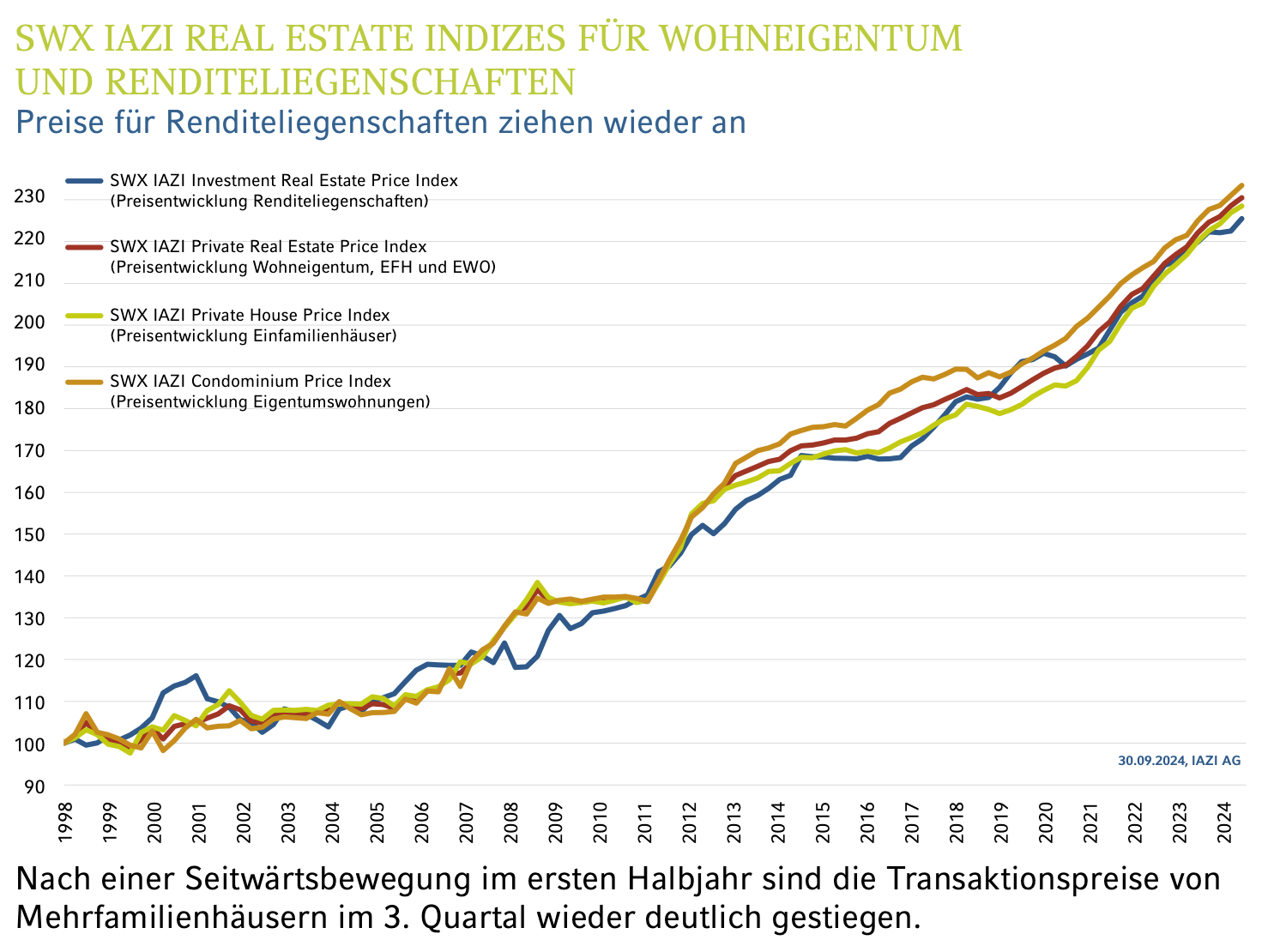

24.10.2024According to IAZI, the breather in the market for investment properties is probably already over, as the analysis of the latest transaction data points upwards again. IAZI writes: “In the third quarter of 2024, prices paid for apartment buildings were 1.3% higher than in the previous quarter, according to the “SWX IAZI Investment Real Estate Price Index”. This measures the price development of rental properties with residential and mixed use based on changes in ownership on the open market. Only data from debt-financed transactions are included. On an annualised basis, the sideways movement in the first two quarters results in a growth rate of +2.6%.”

For IAZI, the pick-up in momentum is not unexpected, “because fundamental factors such as the interest rate environment and immigration favour the attractiveness of direct property investments.” In addition, falling key interest rates are driving up the price of property investments because, unlike comparable alternative investments such as bonds, investors do not have to accept a reduction in returns. They are therefore prepared to invest in property at higher prices.

Watch the market commentary by Donato Scognamiglio, Chairman of the board of IAZI AG, on YouTube here:

However, according to the IAZI, whether the falling mortgage rates will have a full impact on the more favourable procurement of debt capital depends heavily on the effects of the Basel III standards, which will come into force in Switzerland as early as 2025. The company writes: “In future, mortgage lenders will have to secure property transactions with a high loan-to-value ratio with considerably more equity, which will make lending, which has already stalled in some places, even more expensive. Whether and how this will affect property prices remains to be seen.”

Robust demand for owner-occupied residential property

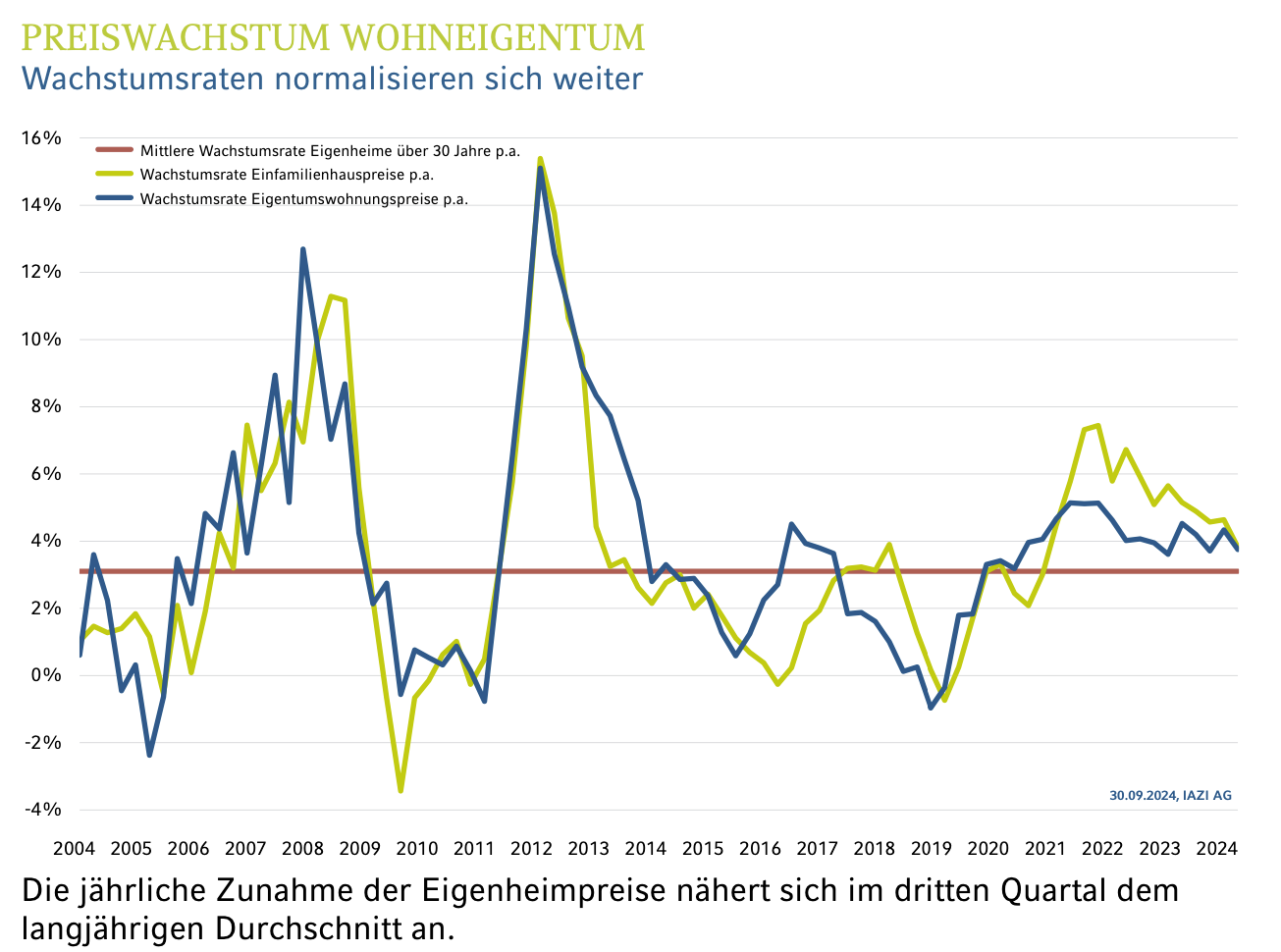

Demand for owner-occupied residential property also remains robust, as shown by the renewed price increase of 0.8% in the third quarter of the “SWX IAZI Private Real Estate Price Index”. The increase is primarily attributable to owner-occupied flats, which were traded at 1.0% higher values. In contrast, single-family homes recorded a slightly lower increase in value of +0.7%. Residential property prices are thus continuing their growth path at a slightly slower pace, which is reflected in an increase of 3.8% over the past twelve months.

IAZI is convinced that this growth will continue, because as long as “the population and its demand for living space continues to grow and economic conditions remain stable, the rising price trend is unlikely to change much. Despite unexpectedly strong construction activity last year, the expansion of available space is not keeping pace. This is also reflected in a further decline in the vacancy rate to 1.1%. Last year, the Swiss housing stock grew by around 50,000 units net, taking into account new construction, conversions and demolitions. This growth roughly corresponds to the number of flats in the city of Lucerne and is in line with the long-term average.”

The majority of the newly constructed properties are rental flats. The vacancy rate of 0.7% for owner-occupied properties is therefore significantly lower than that of rental properties (1.5%). The net increase in single-family homes is an example of the shortage in the residential property submarket: The stock increased by just around 4,000 units in the past year − all other market activity is concentrated on existing properties, resulting in sustained price pressure.