Stagnating to slightly falling property prices

In its latest report on the development of real estate prices as of the end of August, Avobis found stagnating or even slightly declining trends. Avobis writes: “There is also a slightly larger supply of advertised properties for sale or rent compared to the previous month. The year-on-year comparison shows: In August 2022, prices per square metre for properties for sale were significantly cheaper than today, which attracted potential sellers. This can be seen in the number of advertised offers, which is clearly higher in August 2023 than in the previous year.”

Prices for flats nationwide had seen a very slight price reduction of 0.94 per cent to CHF 7,000/m2 in August 2023. This broke the steady, but only slight, rise in prices that had been going on since May 2023, Avobis writes. According to the report, however, prices for the purchase of single-family homes: “The average price for a single-family home stagnated for the third month in a row at a price of CHF 7,127/m2.”

Avobis draws the following conclusion: “While economic conditions are becoming clearer, there is a clear trend towards activity on the supply side. This promises potential buyers greater choice. At the same time, stable prices signal continued demand that may be able to absorb this supply. It will be interesting to watch developments in the coming months.”

Entscheid der Schweizerischen Nationalbank zum Leitzins erwartet

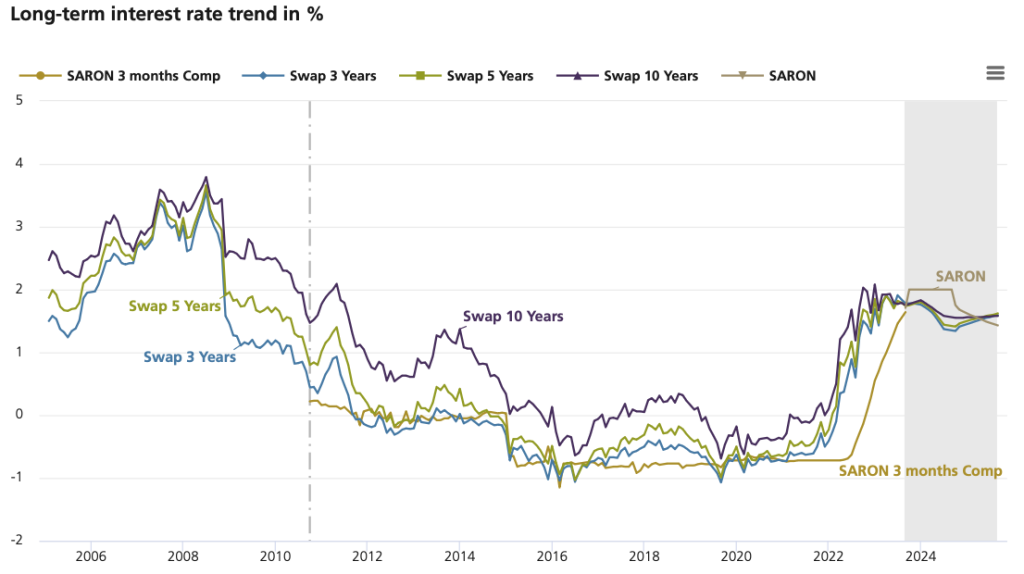

Die wirtschaftliche Lage in der Schweiz macht eine Prognose zum Leitzinsentscheid der Nationalbank am 21. September schwierig. Einerseits zeigen die Daten zum Schweizer Wirtschaftswachstum im zweiten Quartal 23 eine Stagnation, anderseits dürfte aber die Kerninflation bei rund 1.5 % und damit unter dem Zielwert der Nationalbank liegen. Diese Faktoren sprechen also klar gegen eine weitere Erhöhung des Leitzins. Aufgrund der steigenden Mieten, der steigenden Krankenkassenprämien sowie die steigenden Energiepreise können aber weitere Inflationsschübe nicht ausgeschlossen werden. Dennoch sieht es avobis als wahrscheinlich an, dass die SNB den Leitzins im September unverändert lässt. Sie schreibt denn auch: “Die Folgen von Mietpreiserhöhungen auf die Inflationsentwicklung sind weiterhin eine Unbekannte, die genau beobachtet werden sollte. Falls bis Ende Jahr keine besorgniserregenden Inflationsschübe auftreten, könnte die Zinskurve einen ausgeprägten inversen Verlauf zeigen, indem der 10-jährige Swapsatz unter dem SARON-Satz liegen würde.”

Den ausführlichen Bericht können Sie hier lesen.

UBS: Stability in the mortgage market continues

Sources: Bloomberg, UBS Switzerland AG; Rates through the end of 2010 are based on Libor, and on SARON from 2011. The effective interest rate of the product is calculated using the margin + compounded SARON of the accounting period. When calculating the interest rate, the compounded SARON can never be less than zero.

UBS comes to a similar conclusion in its analysis of the current mortgage rates and interest rate forecast: “In August, mortgage rates and government bond yields hardly moved. Thus, the development of the preceding months continued. The Swiss capital market is probably waiting to see what outlook the Swiss National Bank (SNB) will give for key interest rates at its assessment on 21 September. The encouraging economic signals from the USA, which are also of great importance for Swiss exporters, argue for an increase in key interest rates. On the other hand, the marked decline in Swiss inflation in recent months and the slowdown in the Chinese economy suggest that the current key interest rates should be maintained. As a middle course, the SNB could raise interest rates again to 2 per cent. At the same time, it could give the market to understand that the cycle of interest rate hikes is now over and that the next step will probably be a rate cut next year. The outlook for possible rate cuts in 2024 should lead to slightly lower interest rates in the coming quarters.”