Are property prices still rising or already falling? The latest transaction data from the real estate consultancy IAZI suggest that the market for apartment buildings in particular has passed its zenith for the time being. This also applies to a lesser extent to the trade in condominiums, whereas demand for single-family homes remains robust. The forecast is based on an analysis currently being carried out, which is based exclusively on the changes in ownership in recent weeks and on pending transactions that have already been reported.

IAZI has carried out this additional analysis, as the assessment of property price development is particularly challenging during a possible trend reversal: The narrowing of the observation period plays a decisive role here. This is also the reason why the published property price indices continue to show growth in all categories on a quarterly basis.

Real Estate Price Indices in Q4 2022 increase by more than 1 per cent compared to previous quarter.

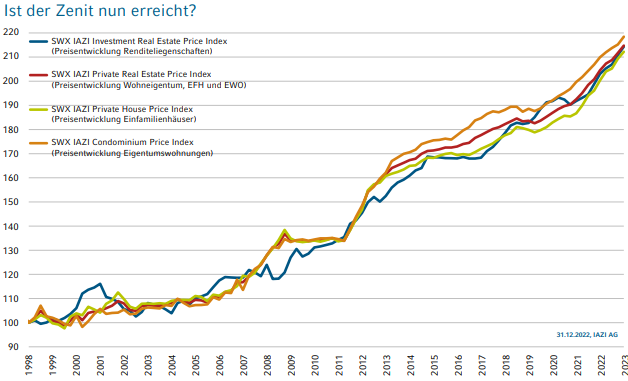

Has the zenith now been reached? Despite recent increases in value, there are increasing signs of a slowdown in price momentum. (Source: IAZI)

The “SWX IAZI Private Real Estate Price Index” for residential property at the end of the 4th quarter of 2022 shows an increase of 1.4 % compared to the previous quarter. Both single-family houses and condominiums contributed to this price growth to practically the same extent. Over the whole of 2022, prices paid for owner-occupied homes were 5.0% higher overall. Homeowners were thus once again able to enjoy a substantial increase in value.

The “SWX IAZI Investment Real Estate Price Index” shows the same picture for the price development of multi-family houses: 1.7% higher values in the 4th quarter of 2022, resulting in an increase of 5.6% over the whole year. The consistently positive growth rates of the published index data are due to the calculation period. Since transactions are included over several months, the published time series react with a certain delay.

Declining willingness to pay for multi-family houses

As mentioned, however, a declining willingness to pay can be observed especially for multi-family houses at the current margin, which will lead to a falling trend for the price index in the coming quarters. The market is thus reacting to the turnaround in interest rates, which was reaffirmed by the Swiss National Bank in its latest monetary policy tightening shortly before the end of the year. “In this respect, the expected price correction for multi-family houses does not correspond to a crash, but to a return to normal,” says Donato Scognamiglio, CEO of IAZI AG. Almost any price was paid for the sought-after yield properties in the negative interest rate environment. Now that key interest rates have returned to positive territory, real estate investments must once again increasingly compete with other investment opportunities.

Prices for single-family homes continue to rise despite interest rate hikes

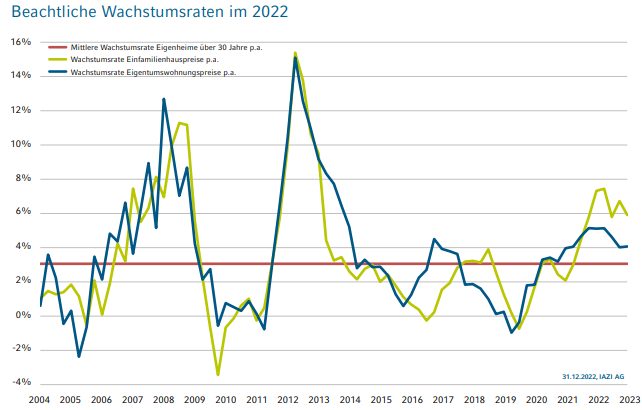

Considerable growth in 2022. Regardless of the interest rate turnaround, home prices have once again increased at an above-average rate. (Source:IAZI)

According to both the price index and the forecast, prospective buyers of single-family homes are unimpressed by the latest interest rate hikes. They are likely to dig deeper into their pockets again in the coming quarters for their own house with a change of scenery.

Watch the market commentary by Donato Scognamiglio, CEO of IAZI AG, on YouTube: