IAZI comments on the interest rate cut to 0.5%.

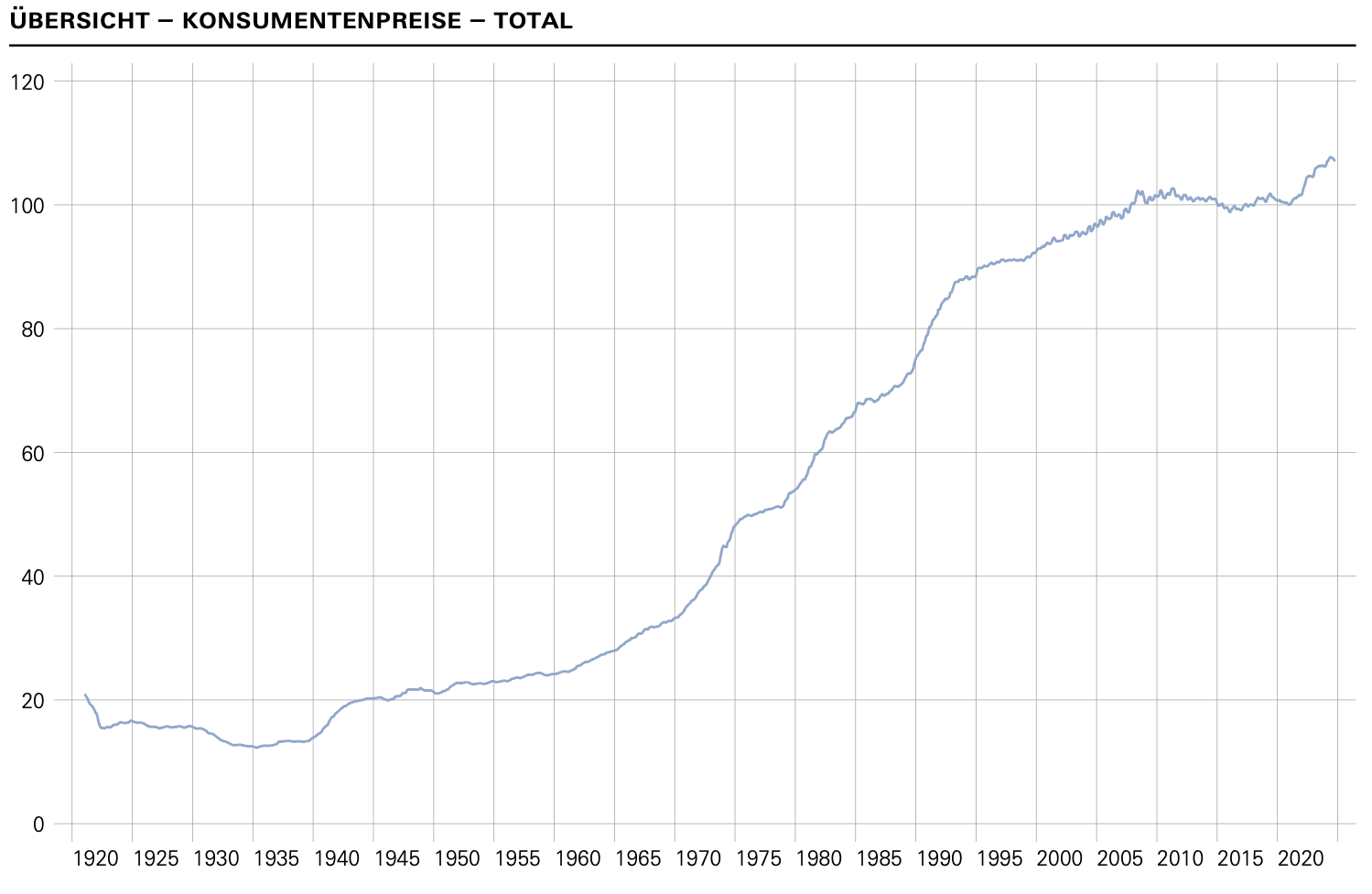

17.12.2024The property valuation company IAZI is convinced that the Swiss National Bank’s reduction of the key interest rate by 0.5 per cent to 0.5 per cent will have a positive effect on the property market. The easing of monetary policy makes sense, as inflation has once again been lower than expected since the SNB’s last assessment of the situation. It has fallen from 1.1% in August this year to 0.7% in November. The central bank intends to take this development into account by significantly lowering the key interest rate. The SNB will continue to monitor the situation closely and, if necessary, adjust its monetary policy to ensure that inflation remains within the price stability range in the medium term.

You can download the Swiss National Bank’s press release on the interest rate cut as a PDF here.

Good news for the property market and housing construction

In its press release, IAZI AG writes that the renewed interest rate cut is good news for the property market, especially for residential construction. In recent years, residential construction activity in Switzerland has been insufficient. The spectre of a housing shortage has been circulating in the media. If immigration continues at the same rate over the next few years, it is highly likely that there will be too few flats in the metropolitan regions to accommodate these people. With the current interest rate cuts, financial support for residential construction will also return. “Apartment blocks will become more attractive again as an asset class,” says Donato Scognamiglio, Chairman of the Board of IAZI AG.

According to IAZI, the renewed reduction in key interest rates is also a positive development for anyone wishing to purchase residential property. The company writes in its press release: “Interest rates for mortgage loans have been falling again in Switzerland since this year. During this phase, many people will choose fixed-rate mortgages with longer terms. Saron mortgages are also likely to come back into the focus of bank customers. They are linked to the Saron money market rate and therefore indirectly to the SNB base rate. Many borrowers withdrew from money market mortgages when interest rates rose again from mid-2022.”

The Chairman of the SNB, Martin Schlegel, commented today on the possibility that the central bank could reintroduce negative interest rates. With the renewed cut in the key interest rate, this scenario is no longer so far away. The SNB could introduce negative interest rates in order to dampen demand for Swiss francs. The strong franc is causing problems for the Swiss export industry, which is having a negative impact on economic development.

Low interest rates also harbour risks for the real estate sector

However, IAZI also warns of potential risks: “A renewed dip into the low interest rate environment would once again cause the well-known collateral damage in the property sector. During the last period of low interest rates, a great deal of money flowed into the construction of apartment blocks due to a lack of alternatives. Institutional investors in particular were desperate to find investment opportunities. As a result, many housing estates were built where there was no demand at all, for example in the outer periphery. The result was high vacancy rates on the outskirts of urban centres. The Emmental municipality of Huttwil became sadly famous at the time with a vacancy rate of 14 per cent.” Donato Scognamiglio, CEO of IAZI AG, said: “No one in the property sector would wish for such scenarios to return.” The SNB would have to take these circumstances into account if negative interest rates were to be reintroduced. “Children are wary of making the same mistake if they are threatened with trouble in their family environment,” Donato Scognamiglio continued. “It remains to be seen what conclusions our central bank will draw from this.”