According to a UBS forecast, the inflation risk in Switzerland should remain manageable. The bank therefore expects mortgage rates to remain low.

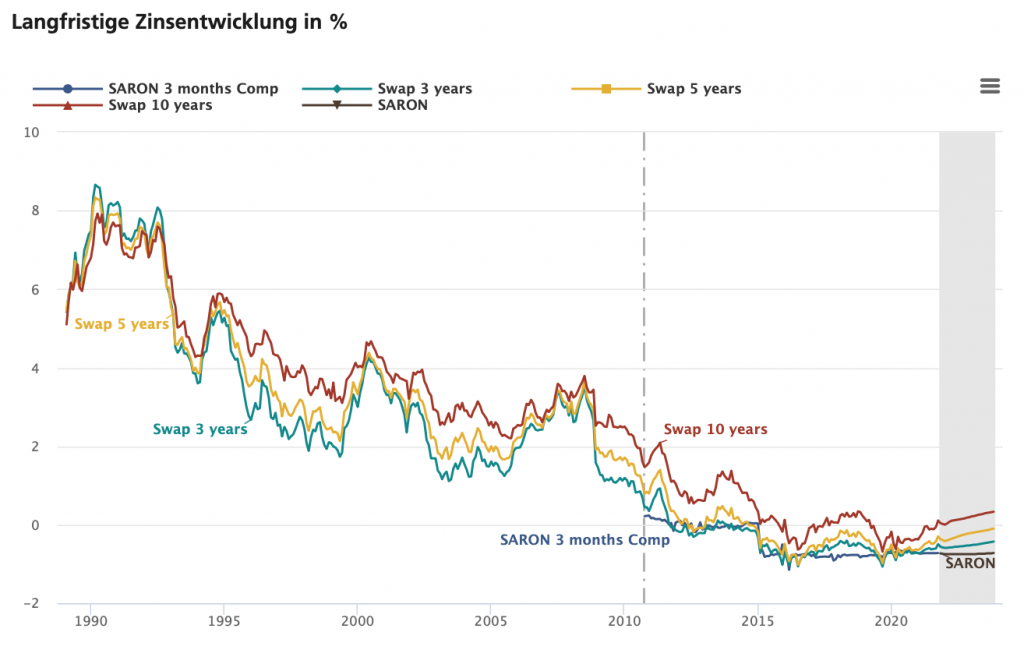

Bottlenecks in global supply and production chains have led to an acceleration of inflation in recent months, UBS writes in its online article. Fears of a strong inflation trend caused 10-year Swiss interest rates to rise to their highest level since 2018 at the beginning of October 2021. However, by historical standards, even these highs are still at very low levels.

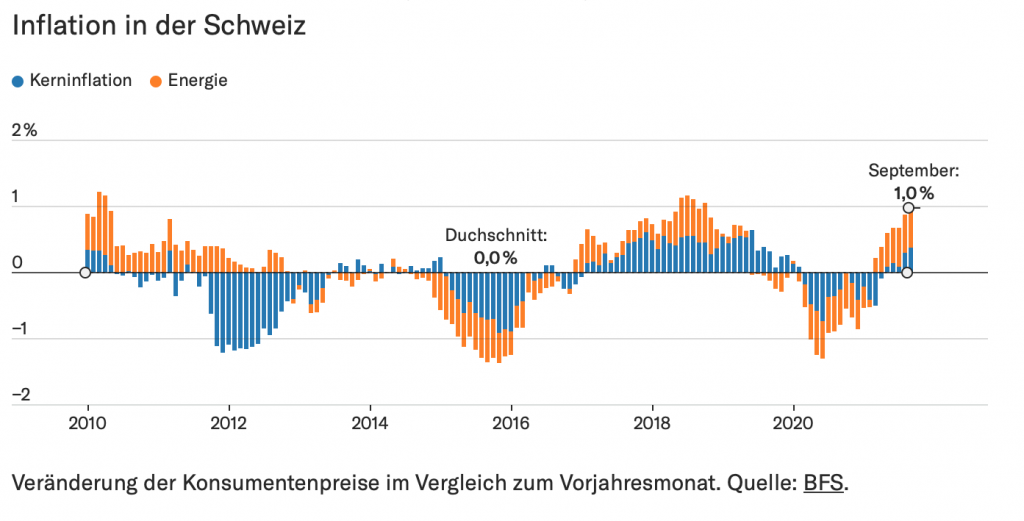

The economic reporter and data journalist Simon Schmid recently dealt in detail with the topic of inflation trends in the Republic under the heading “In the long run”. The very readable and well-founded article (in German only) uses data series to address the questions of what to make of the recent rise in coal, gas, oil and electricity prices, how the world economy is doing at the moment (in the grand scheme of things and in connection with the Corona pandemic) and whether inflation is imminent and whether we need to worry that everything will soon cost more. His conclusion for Switzerland in brief: No, there is no threat of high inflation rates here, neither temporarily nor permanently. The following chart makes this clear.

Screenshot Republik, Source: BFSUBS also expects oil prices to stabilise in the coming quarters, bottlenecks to be eliminated and inflation to level off again. If inflation normalises, however, mortgage rates and interest rates on government bonds would hardly have any upward potential, the bank writes further. The National Bank’s negative interest rate policy prevents a further rise in Swiss interest rates. They are likely to remain at a low level.

Source: Bloomberg, UBS Switzerland AG; Values up to and including 2010 are based on Libor and from 2011 on SARON. The effective interest rate of the product is calculated from Margin + Compounded SARON of the respective settlement period. For the calculation of the interest rate, the Compounded SARON can never be less than zero.