An end to the negative interest rates is not foreseeable even after more than 5 years, writes UBS in its online magazine – and wonders how the real estate market has developed during this time.

The negative interest rates have channelled a lot of capital into the real estate market; in the meantime, the interest rates for Swiss government bonds have been negative for all available terms. This has made debt financing cheaper, distorted the cost ratio between residential property and rented apartments, and made investment properties much more attractive than bond investments, according to the worthwhile article by Matthias Holzhey and Maciej Skoczek. (in German only)

Owner-occupied homes have become an investment; every sixth sold apartment is currently rented out. «At current purchase prices, rents and interest rates, the annual living expenses of new owners are around 15 percent lower than those of tenants of an equivalent apartment. The return on equity for owner-occupied dwellings with a loan-to-value ratio of two thirds is a handsome 4 to 5 percent,” the authors write.

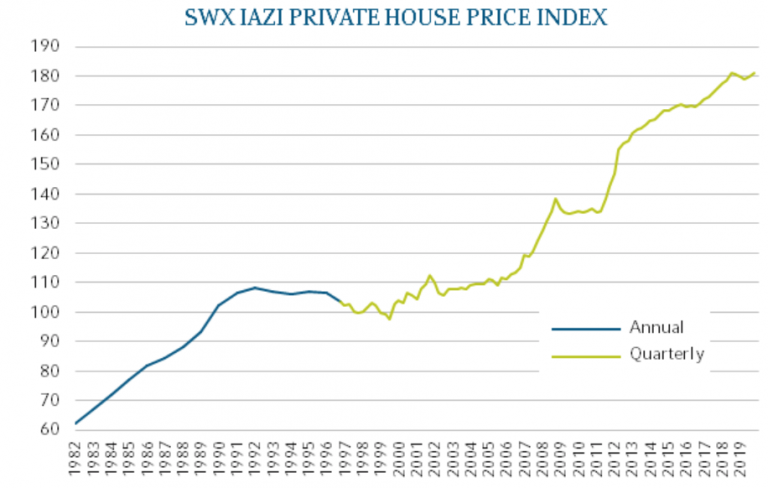

Against the backdrop of continuing low interest rates, the authors believe that the price of owner-occupied housing will continue to rise unabated, despite certain vacancies. Their conclusion: “On market average, house prices rose by 0.6 percent in the second quarter of 2020, which is 2.7 percent higher than a year ago. Adjusted for inflation, the price increase of 4 percent was the strongest since 2013”.