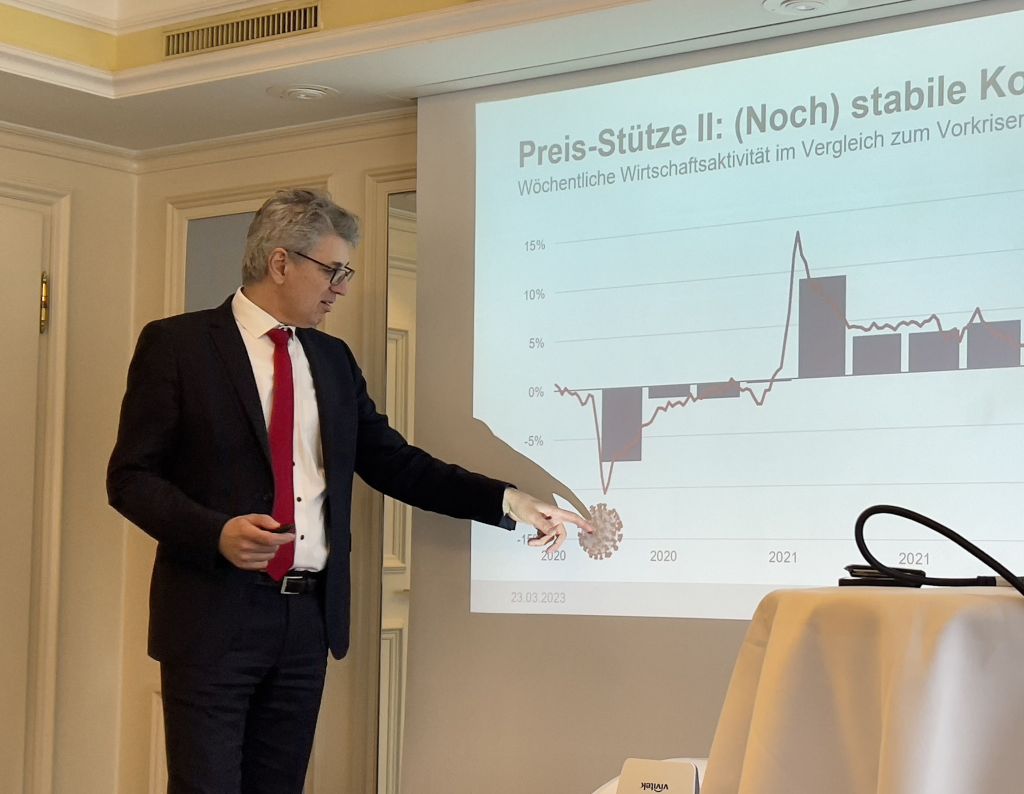

At a media conference on the publication of the IAZI Swiss Property Benchmark, IAZI CEO Prof. Dr. Donato Scoganamiglio was positive about the course of business in 2022. For Swiss real estate investors, the course of business is basically positive. However, the consequences of the interest rate turnaround are already being felt. Scognamiglio said: “Last year, real estate investments were the only asset class that did not crash.”

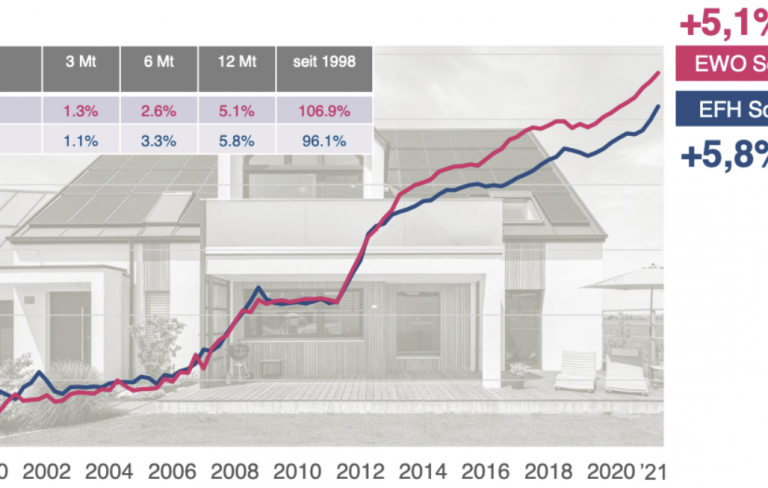

Direct real estate investments have clearly outperformed all other Swiss asset classes in terms of total return. (Source: IAZI, SIX as of 16.3.23)

In 2022, shares and bonds lost value, while real estate valuations remained stable or even increased. In many portfolios, this led to an excessive increase in the real estate share and to the sale of properties. In addition, higher interest rates make it possible for investors to achieve attractive returns with forms of investment other than real estate. Swiss mortgage bonds with a 10-year term and AAA rating, for example, offer a risk-free return of around 2%. Concrete gold has lost its shine in comparison.

Donato Scognamiglio, CEO IAZI AG, said at the media conference: “Last year, investments in real estate were the only asset class that did not crash.”

In addition to the economic explanation, the current discussion is characterised by strong emotionality. Anyone currently looking for a flat in the big cities of Geneva, Zurich, Lucerne or Zug must be patient. The vacancy rates in these cities are well below one per cent, which means that there is a de facto housing shortage.

Decline in performance mainly affects commercial properties

Overall, 2022 was a positive year for Swiss real estate investors. The consequences of the turnaround in interest rates are already being felt; yields have diminished somewhat overall, but investments in real estate still pay off. According to IAZI, domestic direct real estate investments (investment properties) achieved a performance of 5.2 % at the end of last year (6.4 % in the previous year). The performance measures the total return of properties. It shows the rental income (minus expenses) and changes in value that investors have achieved with their properties. The decline in performance is somewhat higher for commercial properties (4.1 %; previous year 5.6 %) than for residential properties (5.9 %; previous year: 7.1 %) or mixed-use properties (5.5 %; previous year: 6.4 %).

IAZI explains the decline by the lower value development. At the end of last year, it was 2.3 % (previous year: 3.5 %). The valuation industry is now more cautious, but a turnaround is not yet discernible, as the values are still positive across all types of use. The decline in value was particularly noticeable for commercial properties (1.1 %; previous year: 2.7 %), while the corrections for residential properties (3.1%; previous year: 4.1%) and mixed-use properties (2.6 %; previous year: 3.5 %) were lower.

According to IAZI, the second component of performance is the net cash flow yield, also known as net cash flow (NCF). This is calculated as follows: Income (actual income) less all property expenses affecting disbursements (property maintenance, administration, heating and ancillary costs charged to owners, insurance, taxes, maintenance and investments), i.e. excluding depreciation and provisions. The NCF yield remains unchanged from the previous year with an overall value of 2.9 %. Only the values for residential properties have corrected minimally (2.9 %; previous year: 3.0 %), while the values for the other property classes remain at the previous year’s level.

“In the current discussions about housing shortages, the impression sometimes arises that investors would achieve yields that would far exceed the upper limits set by the Federal Supreme Court in rental law practice,” says Donato Scognamiglio, CEO of IAZI AG. “The present evaluation of the authoritative real estate portfolios speaks a different language.” At the current reference interest rate of 1.25%, the upper limit is 3.25%. The NCF yield has steadily declined over the past 10 years to 2.9% today. In general, NCF yields are lower in cantonal hotspots such as Zurich (2.8%), Geneva (2.4%) or Vaud (2.9%) than in rural cantons such as Lucerne (3.3%), Bern (3.2%), Neuchâtel (3.6%), Fribourg (3.6%) or St. Gallen (3.2%). However, these are average values.

Rents are under upward pressure

Housing shortages occur where more demand for housing meets too low a supply.

The actual rent calculated in the Swiss Property Benchmark (i.e. the target rent minus the unrealised rent) is relevant for real estate investors, writes IAZI in its media release. It is currently CHF 241/m2 of usable space per year and had increased by 2.5 % by the end of last year. The highest rent increase was achieved by mixed-use properties with 2.8 %, followed by commercial properties (+2.6 %) and residential properties (+2.3 %).

It is striking that the rent premium turned out to be higher compared to the previous year in cantons that tended to be more affected by flat vacancies, such as Aargau (+3.1 %) or Ticino (+6.2 %) than cantons with low vacancy rates, such as Zurich (+1.7 %), Geneva (+0.0 %) or Basel (+0.0 %). In the latter two cantons, stricter rent control laws are in force.

According to IAZI, the highest vacancy rates have occurred where no one actually wants to move, while the vacancy rate has always remained chronically low in the cities, where demand for housing has always tended to be highest. In this respect, it is positive for the municipalities if the ghost settlements fill with life and generate new income for the municipal coffers. In the IAZI Swiss Property Benchmark, vacancies or their reduction can be seen in a minus value in the so-called unrealised rent. The unrealised rent is made up of the items vacancy, discounts and rent defaults.

In fact, the value at the end of 2022 has decreased by 0.9 percentage points across all analysed uses and amounts to 4.2 % (previous year: 5.1 %). The value for mixed-use properties fell the most, from 5.9 % in 2021 to 4.2 % in 2022, while the reduction for commercial properties was more moderate, from 6.8 % (2021) to 6.1 % (2022). For residential properties, the value at the end of 2022 has decreased by 0.8 percentage points overall and amounts to 2.8 % (previous year: 3.6 %).

In terms of a conclusion, IAZI writes: “Overall, the past year was very successful for direct real estate investments. Although interest rates have risen, they have not led to a reduction in property valuations. Instead, they have merely weakened the strong appreciations of previous years. The increase in rents, triggered by high demand, has reduced vacancies and stopped the erosion of net cash flow yields.”