The real estate consulting and valuation company IAZI AG has just published its latest figures on the Swiss real estate market. The conclusion for private residential property is simple and brief: “Robust demand is being matched by tighter supply, which should continue to support prices for condominiums and single-family homes.”

Cautious optimism about economic development

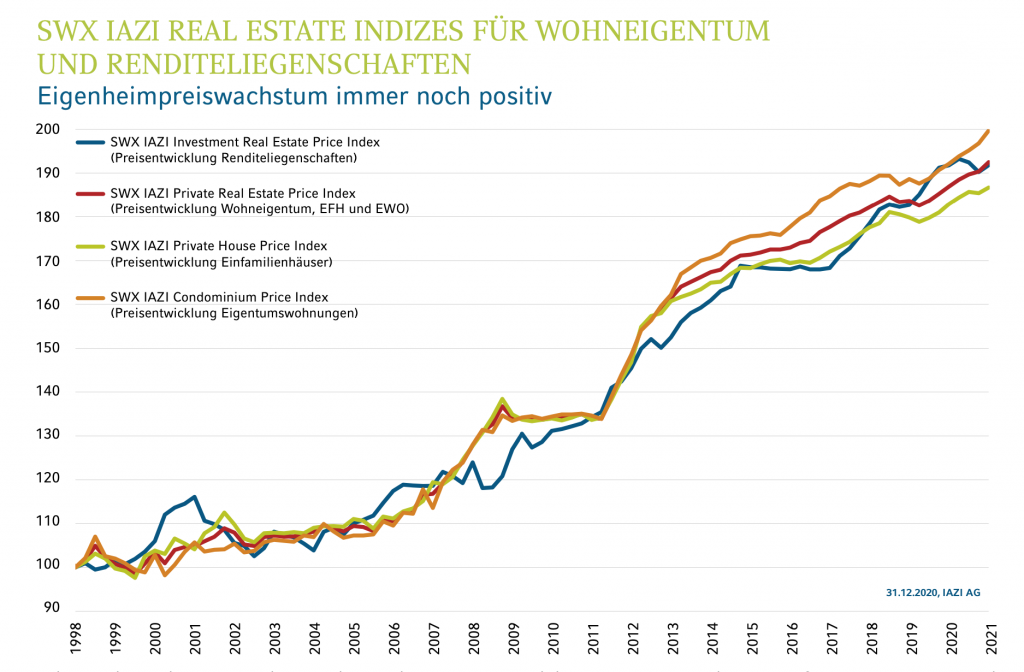

Economically speaking, the new year begins with cautious optimism. Economic researchers expect solid growth in gross domestic product again in 2021. The real estate market proved to be very resistant to the recession last year, especially in the residential property segment. The “SWX IAZI Private Real Estate Price Index” for private residential property (single-family houses and condominiums) shows an increase of 1.1% in the 4th quarter of 2020 (previous quarter: 0.3%).

Those who invested in the residential segment (owner-occupied homes or apartment buildings) in 2020 did not do anything wrong. This insight is also reflected in the development of the stock market prices of indirect real estate investments. Securities or companies that concentrate on residential real estate have performed particularly well. In some cases, their stock market performance in 2020 showed an increase of up to 20 percent or more. On the other hand, companies that invested primarily in commercial properties were often under pressure. The pandemic is clearly leaving its mark here.

For a brief summary of the situation, you can view the market commentary in German language on the 4th quarter of 2020 by Professor Dr Donato Scognamiglio, CEO of IAZI AG, here:

Transaction prices for private residential property

The continued attractive financing conditions have stimulated demand for one’s own four walls. Source: IAZI AG

Condominiums recorded uninterrupted price growth of 1.5% in the 4th quarter (previous quarter: 0.8%). On an annual basis, price growth has increased by 0.8% and now amounts to 4.0%. Compared to condominiums, price growth for single-family homes was slightly lower at 0.7%. “The Corona crisis has definitely brought housing to the forefront of many people’s minds,” says Donato Scognamiglio, CEO of IAZI, “and in conjunction with this, the desire to optimise their housing conditions has probably emerged for many,” Scognamiglio continues. The continued attractive financing conditions have stimulated the demand for one’s own four walls. On the other hand, the construction momentum for private residential property cooled down last year. Robust demand is therefore being offset by a shortage of supply, which should continue to support prices for condominiums and single-family homes.

Transaction prices for apartment buildings

In the 4th quarter, price growth for multi-family houses increased only slightly at 0.8%. On an annual basis, prices have stagnated at 0.0%. Stricter financing rules for income properties and increasing vacancy rates have ensured that price growth for multi-family houses has cooled since last spring. “However, very many institutional investors are still looking for opportunities to invest in multi-family houses and are willing to pay high prices,” says Donato Scognamiglio. In the current economic situation, the interest rate turnaround has once again become a distant prospect. “Thus, investors are still offered interesting investment opportunities in concrete gold.”