Luxury Defined, the online magazine of Christie’s International Real Estate, sat down with the Co-CEOs, Mike Golden and Thad Wong, to discuss the current luxury property market and the trends that are shaping their outlook for the remainder of the year. Their conclusion: the luxury real estate market has shown little sign of slowing down thus far in 2023. With demand still outpacing supply in many locations, a strong U.S. dollar, and the reopening of Asian markets, there is plenty to feel positive about despite the economic turbulence being felt around the globe.

Commenting on the state of the market, Golden and Wong said: “The last three years were unprecedented in terms of luxury home sales, but we’re entering a period now that may be even better in terms of stability and sustainability. Granted, the cost of money has increased, but a number of other factors point to a positive trend. One long-term effect of the pandemic is that it refocused people’s attention on real estate.

Christie’s International Real Estate Co-CEOs, Mike Golden and Thad Wong

Obviously, a great deal of wealth has been created in recent years, the 2022 equity markets notwithstanding. It’s likely that we’ll see a boomlet behind the reopening of Asia. Plus a weak euro has drawn foreign property buyers to the EU. And in a lot of luxury markets, demand still outpaces supply. Buyers are definitely a little more judicious now, which is good, but looking ahead several years, we believe we’re set up for a strong global luxury market.”

According to them, there is a more rational approach in the marketplace, and, again, that’s a positive. “A-plus” properties are still selling quickly and commanding, in many cases, record prices. But most properties aren’t perfect – whether it’s location, condition, design, etc. And those sellers are going to have to accept a commensurate discount.

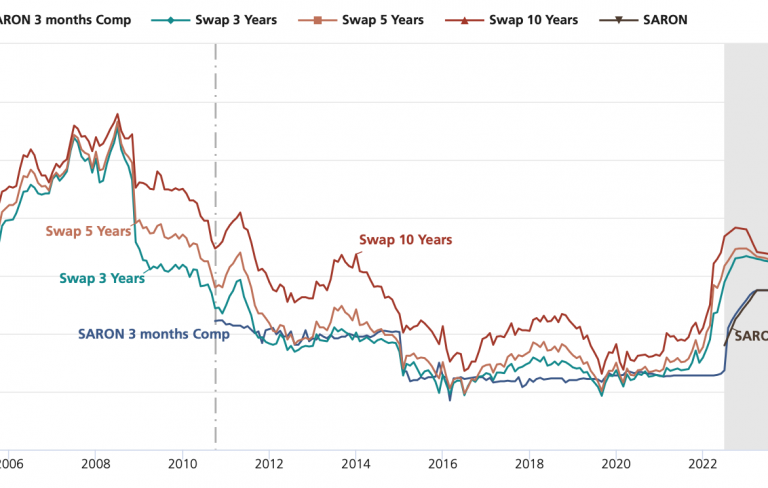

They comment on the rising interest rates like this: “Most encouraging is that demand appears to be stronger than the market was betting on at the end of last year. And to the extent that interest rates impact the high end, the resilience of buyers has been somewhat of a revelation. People have adjusted more quickly to higher rates, understanding that it’s a temporary situation that can be actively managed.”

They are particularly confident about the fact that, especially in the luxury real estate sector, the availability of suitable properties is still the central problem. Golden and Wong said in the interview: “It’s not that there aren’t homes for sale. It’s that many are held in the private market, and the quality properties that do make it to the open market sell very quickly.

We don’t see the inventory picture changing much throughout 2023. We’re going to be dealing with lower-than-normal levels, and the silver lining there is that it’s going to buoy prices.

People talk about a soft landing in the economy, and we’re watching a similar dynamic in the housing market – the delicate dance of inventory, demand, prices, borrowing costs and, to some degree, employment, and where it all settles. Right now, fingers crossed, things are looking pretty good.”

Read the full Interview with Golden and Wong here.