It may be a little confusing, because while the National Parliament is currently debating the abolition of the so called “Eigenmietwert“ (imputed rental value), the canton of Zurich will increase it for the 2026 tax period. In an online publication, ZKB has now shown in the form of model calculations what this will mean for which owners in their respective municipalities, assuming a marginal tax rate of 15 per cent.

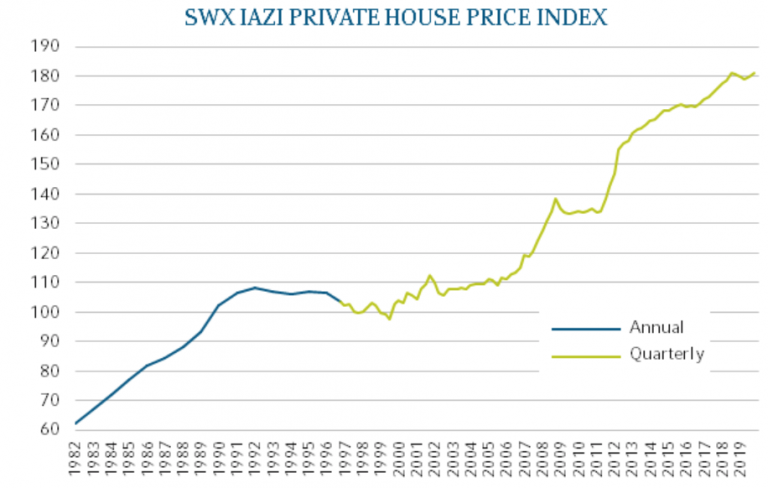

The ZKB writes that the adjustment has become necessary ‘as the existing calculation basis dates back to 2009 and property values and rents have risen significantly since then.’ Not surprisingly, the main driver of rising property values is the sharp rise in land prices.

Average increase in land values as at 2026

Average increase in land values of single-family homes (left) and condominiums (right) according to the new 2026 directive

The uncertainty about the planned revaluation is great and the ZKB has therefore ‘scrutinised the new directive and simulated how the imputed rental value will change for every owner-occupied home (detached houses and condominiums) in the canton of Zurich.’ The calculation is based on information on location classes, property areas and building volumes. The ZKB points out that in individual cases the calculated results will differ from the actual increase in imputed rental value, which is then determined by the tax office.

Owners of older properties benefit from lower building values

The ZKB writes: ‘In addition to the land value, which will increase after the tax reform, the imputed rental value depends on the building value of the property, the so-called current building value. For the calculation, the replacement value of the property is depreciated according to the building insurance with an age factor. Currently, property owners can claim an age depreciation of 1 per cent per year on ageing up to 2009, whereby a maximum of 30 years can be taken into account. For example, a detached house built in 1984 was already 25 years old in 2009, which corresponds to an eligible age depreciation of 25 per cent. With the new tax regulation, age depreciation can now be claimed until 2026 up to a building age of 40 years. For the example house, an age depreciation of 40 per cent would now have to be taken into account, as it will already be 42 years old in 2026. This means that 15 additional years can be counted as a result of the change. The situation is less positive for a condominium from 2022, for example. Previously, no age depreciation could be claimed here. Now 4 additional years will be possible. The new building values are therefore good news for owners of older properties. Specifically, owner-occupied properties built between 1986 and 2009 enjoy the greatest additional age depreciation. Those who have only recently moved into their newly built home will hardly benefit from any additional depreciation on the value of the building. This leads to a surprising result: owners of older properties, who have enjoyed the greatest increase in value in terms of building value, are in a better position than newly built owners. In addition to the age depreciation, it is forgotten that the assessment of the imputed rental value of new buildings was also based on old basic data.’

Nevertheless, the “Eigenmietwerte“ are likely to rise only moderately overall

The ZKB has estimated how the imputed rental value is likely to change for all owner-occupied properties in the canton due to the adjusted location values and the changed age depreciation. It comes to the following conclusion: ‘Despite the sharp rise in land values, the results, as the bar chart below shows, indicate a surprising all-clear for most owners. For around half of the properties, residents can expect an increase in their imputed rental value of over 5 per cent. On average, it is +14 per cent for detached houses and +19 per cent for condominiums. According to our estimates, the residents of one in five properties are affected by an increase in imputed rental value of more than 15 per cent. 27 per cent (single-family homes) and 31 per cent (condominiums) can take a more relaxed view of the reform, as they do not have to expect a significant change in imputed rental value. The pleasant surprise is that property owners in the remaining quarter can actually look forward to the reform: Their imputed rental value is likely to fall.’

The development of imputed rental values varies from municipality to municipality

The ZKB chart shows the proportion of single-family homes and condominiums for which the imputed rental value decreases, remains the same or increases in the simulation calculation, in per cent

The ZKB’s conclusion: Is everything half as bad?

All in all, according to the ZKB, there is no reason for most owners to be overly concerned. Anyone who also has the impression that the assessed imputed rental value is too high can request an individual assessment of the achievable market rent. In addition, a hardship rule has been announced which should provide a remedy in the special case of an excessive burden on the cost of living. Owners who are facing a larger tax increase can also hope that the imputed rental value will soon be cancelled for good anyway.

You can read the full ZKB article here.