Donato Scognamiglio, Chairman of the Board of Directors of IAZI AG, reported on the situation on the Swiss property market. He briefly summarised the following conclusions based on his analysis. Although the Swiss economy is weakening, he said, it is on a good course overall. Unimpressed by this, the property market is not yet showing any signs of a correction; prices for residential property are continuing to rise. While existing rents are likely to fall slightly due to the reference interest rate falling again, asking rents in urban centres and tourist regions are rising sharply. In the mountain regions, holiday flats are booming, but this is causing problems for locals and seasonal residents. In his view, a revision of the Lex Weber seems unavoidable in this situation.

Per capita economic output stagnates

According to Scognamiglio, Switzerland’s economic engine has slowed down somewhat this year. Per capita economic output has stagnated since 2022. Nevertheless, the economic balance for this year is cautiously positive.

Unemployment remains at a low level, while the inflation rate has fallen to a record low of 0.6% this year. The key interest rate currently stands at 1 per cent. The new SNB Chairman Martin Schlegel believes that further easing is likely.

When will Switzerland reach 10 million?

According to a scenario from the Federal Statistical Office (FSO), the 10 million mark is likely to be reached by 2040. If Switzerland continues to motivate companies to settle in the country through an attractive location policy, the labour force will also come to our country. This is good news in itself, as these workers will fill the gap left by the retirement of the baby boomers. However, all these immigrants need flats that meet a high standard of living and should ideally be close to their place of work. Theoretically, there are sufficient reserves of building land, but these reserves will be exhausted over the next few years, especially where the demand for housing is highest.

Keine Preiskorrektur für die Schweiz

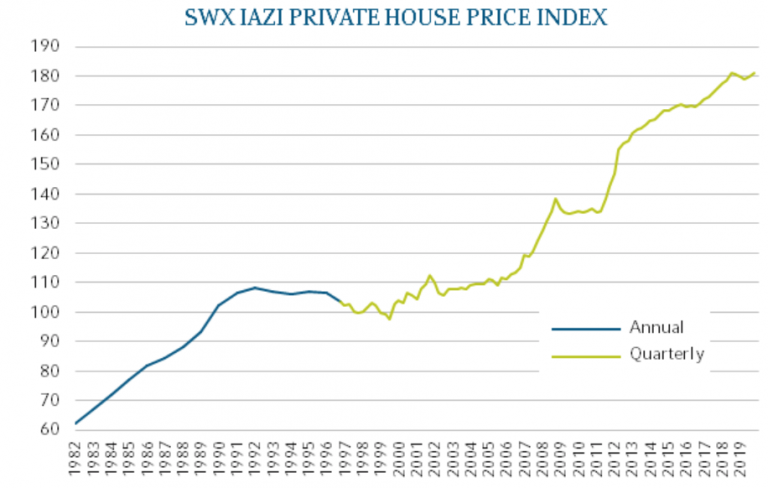

The IAZI press release states: ‘The local property market continues to record record values. While neighbouring countries such as Germany (-12.2%) and France (-4.5%) have had to accept some severe price corrections in the last 24 months, Switzerland continues to shine as the best in class.

‘In the last two years, prices for private residential property have risen by +8.9%. Since 1998, the price increase for owner-occupied homes is +130.5%, in the last 12 months the price growth was +3.8%, and in the last 6 months the prices have appreciated by +2.0%.’

Revaluation of investment properties

Based on the latest data from IAZI, the market for investment property has been an unstoppable success story for 25 years. The often-cited bursting of a price bubble has not materialised, said Scognamiglio, although there have been repeated minor downturns in the price curve. Many factors indicate that the sector will revaluate investment property again next year. The reasons for this are the SNB’s key interest rate, which is likely to fall further, the continued strong demand for residential property due to ongoing immigration and the associated rise in asking rents.

Price heat in the snow regions

However, housing shortages are not only an issue in the large metropolitan regions. Flats have also become very scarce in the mountain regions, writes IAZI. This is also due to the fact that the market for holiday flats in tourist regions has experienced a real boom in recent years. IAZI writes: ‘Following the adoption of the second homes initiative, the market was not under a good star. Stagnating prices and a conspicuous number of properties advertised for sale characterised the picture at the time. During the Covid period, many Swiss people rediscovered their own country as a holiday destination due to the travel restrictions. In addition, Swiss tourism has largely recovered and is building on previous successes. Around 41 million overnight stays were recorded in 2023, slightly more than in the pre-corona year 2019 (39 million).’

In some mountain communities, the proportion of second homes prescribed by law of 20% is far exceeded. In Arosa, for example, the proportion is 75%, in Scuol 61%, in Obergoms 79% and in Grindelwald 63%. Prices for second homes have increased by +48% since 2015, while prices rose by +14% in 2023 alone. The snowless winters will continue to boost the attractiveness of holiday flats, especially in destinations located at an altitude of 1000 metres above sea level.

Live in the valley and work on the mountain

The situation will become particularly problematic for locals and seasonal workers if the gap between the development of asking rents and nominal wages continues to widen. Seasonal workers also have to accept longer journeys to work if they can no longer find affordable accommodation near their place of work. The example of Zermatt shows how workers are moving further and further into the valley to take advantage of the differences in rents. In Zermatt, the rent is 3,270 Swiss francs, while about a thousand metres further down in Viège the rent is only 1,850 francs, a difference of 43%.

Affordable accommodation partly as airbnb

Because everyone can become a host via airbnb, flat owners are now active in tourism alongside hotels. The flats in which hotel and hostel employees used to live are now advertised as lucrative airbnb flats. At the end of this development is the airbnb landlord who can no longer find cleaning staff for his flat because the latter can no longer find affordable accommodation in Zermatt and the surrounding area. Or the hotel that has to close reception early in the evening because the receptionist has to catch the last train down to the valley, as a Swiss financial newspaper recently wrote.

IAZI therefore sees no relief in the mountain regions: ‘Low vacancy rates in tourist regions point to the Alpine housing shortage. Only in Ticino is the vacancy rate currently above 3 per cent in some places. In view of this fact, many local initiatives are being launched to give the locals some fresh air to breathe. These include, for example, direct financial aid or subsidies, but also restrictions on Airbnb lettings or the construction of flats for seasonal workers. However, many problems point to a long-overdue revision of the Lex Weber,’ said Scognamiglio on the property market in the tourist regions.