Would you like to buy a vacation home in the near future and are wondering whether and how you can finance it? As the rules for holiday properties are not the same as for owner-occupied residential property, UBS recently explained in an online article what you need to bear in mind when financing. For example, buyers must provide a higher level of equity and cannot draw on pension assets.

Source: UBS

Source: UBS

UBS explains: ‘The lower loan-to-value ratio is due to the greater default risk for the bank. In the event of financial difficulties, owners are the first to sell their holiday homes, often for less than the purchase price. … In contrast to owner-occupied residential property, you cannot use capital from your occupational pension scheme (2nd pillar) and tied pension provision (pillar 3a) for holiday homes. This makes it more difficult to finance. In the affordability calculation, the financing contribution is calculated using an imputed interest rate of 5% per annum, as for owner-occupied homes. This is to ensure that the financing is on a solid footing in case interest rates jump upwards. Annual amortisation, maintenance and ancillary costs are also factored in.’

According to the bank, holiday flats are also sold more quickly than residential property. It therefore recommends planning at an early stage how long the holiday home is to be used in order to plan the amortisation periods of the mortgages. Otherwise, additional costs and fees could be incurred.

For all those who would like to calculate whether they can afford the holiday flat of their dreams, UBS provides an online calculator here.

Source: UBS

In addition, tax aspects should also be taken into account when buying, as owning a holiday home has an impact on income tax, as an imputed rental value is also added to your income for the second home. In return, you can deduct mortgage interest and maintenance costs from your income for tax purposes.In addition, tax aspects should also be taken into account when buying, as owning a holiday home has an impact on income tax, as an imputed rental value is also added to your income for the second home. In return, you can deduct mortgage interest and maintenance costs from your income for tax purposes.

UBS study: vacation rental market

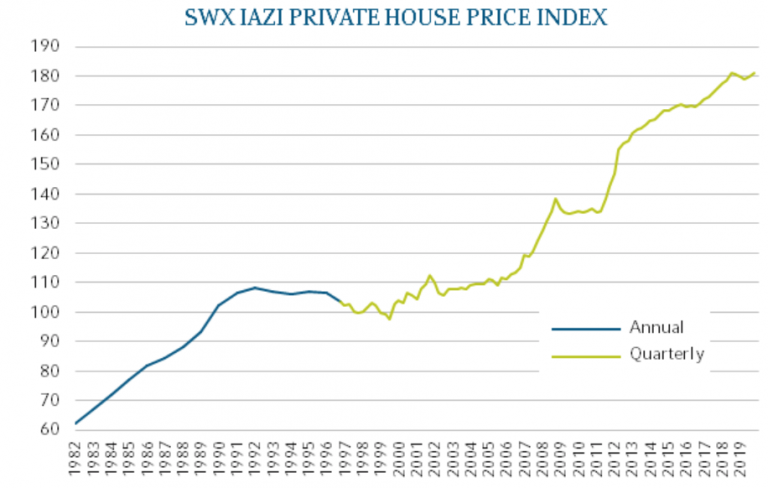

According to the “UBS Alpine Property Focus”, Swiss vacation apartments increased in price by almost 4 percent last year. Find out more about the situation on the second-home market in 33 Swiss vacation destinations. If you are interested in the entire publication, you can download it here as a PDF.