According to IAZI, the Swiss property market is showing opposing trends at the end of the second quarter of 2024. The company writes: “While the willingness to pay for residential property continues to grow, the price trend for investment properties is stagnating. However, current conditions suggest that the price momentum for investment properties could also pick up again in the medium term.”

Watch the market commentary by Donato Scognamiglio, Chairman of IAZI AG, on YouTube here:

Considerable price increases for owner-occupied homes

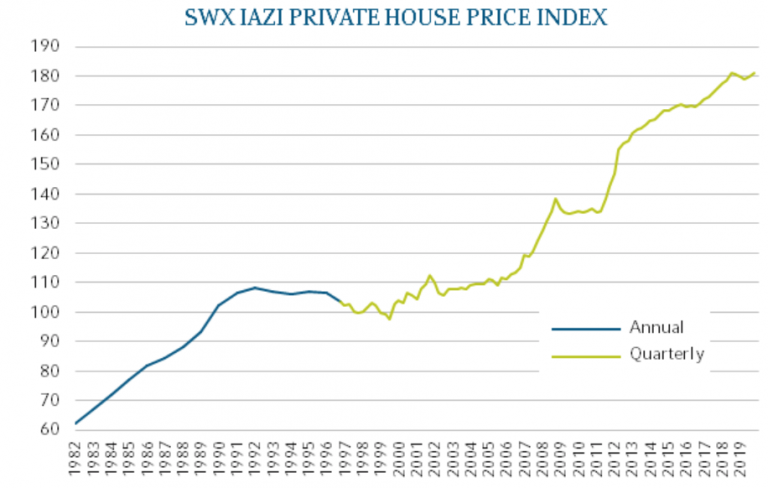

IAZI continues: “While the residential property market seemed to be calming down in the spring, there was no sign of this at the end of the second quarter. According to the “SWX IAZI Private Real Estate Price Index“, the actual transaction prices paid on the market rose by 1.1% between the beginning of April and the end of June. This represents an impressive increase of 4.5% in home values over the past twelve months. The values of single-family homes (+1.2%) grew in line with those of condominiums (+1.1%) in the past quarter. In the long term, however, a slightly stronger increase can still be observed for condominiums. Regionally, the strongest increases in value were once again registered in Central Switzerland and the Alpine tourist regions.”

Apart from the already very high entry price threshold, there is currently nothing to suggest that the owner-occupier market is turning away from its growth trajectory. The high price pressure is due to the constant shortage of supply. A trend reversal is not foreseeable in this respect. Although there are numerous political efforts to promote and simplify residential construction activity, the focus is on expanding the supply of rental flats. The current interest rate environment is not detrimental to the demand for residential property either: with a further reduction in key interest rates by the Swiss National Bank (SNB), money market mortgages (Saron-based) became cheaper again in June. A third reduction could follow in the autumn. The costs of fixed-rate mortgages have also fallen significantly again. This will further ease the burden on homeowners’ budgets.

Apart from the already very high entry price threshold, there is currently nothing to suggest that the owner-occupier market is turning away from its growth trajectory. The high price pressure is due to the constant shortage of supply. A trend reversal is not foreseeable in this respect. Although there are numerous political efforts to promote and simplify residential construction activity, the focus is on expanding the supply of rental flats. The current interest rate environment is not detrimental to the demand for residential property either: with a further reduction in key interest rates by the Swiss National Bank (SNB), money market mortgages (Saron-based) became cheaper again in June. A third reduction could follow in the autumn. The costs of fixed-rate mortgages have also fallen significantly again. This will further ease the burden on homeowners’ budgets.

In its “Einschätzung Zinsmarkt Juli 2024“, avobis – a company specialising in property and financing services – also expects the key interest rate to be cut to 0.75% in the medium term. It writes: “We expect a further cut in the key interest rate in September. We do not rule out an additional cut in December. We expect a key interest rate of 0.75% after the March 2025 meeting at the latest.”

Market for investment properties moves sideways

The situation is different on the market for investment properties, which has now moved sideways for the second quarter in a row, writes IAZI. “In the second quarter of the year, values remained virtually unchanged at +0.2%, as the «SWX IAZI Investment Real Estate Price Index» shows. This measures the price development of apartment buildings and mixed-use investment properties on the basis of actual changes in ownership at market conditions, whereby naturally only data from transactions financed with borrowed capital are included in the calculation. Over the past twelve months, the growth rate of the price index is still slightly positive at +1.8%.”

IAZI expects prices for property investments to rise again

It had been expected that the market for property investments would calm down, at least temporarily, since the negative interest rate environment was abandoned in June 2022. However, a continuation of the current pause is questionable given the robust economic and demographic development. The demand for labour from local companies appears to be unabated, with cumulative net immigration in the first five months of the current year already exceeding 30,000 people according to figures from the State Secretariat for Migration. Demand for space, especially for residential use, but also for office and commercial properties, therefore remains extremely robust. This is reflected in a rising trend in new rents. Even if the return to (low) positive interest rates has curbed the property boom somewhat for the time being and other asset classes have become more attractive, investment properties remain interesting for investors due to the pleasing outlook on the income side. Sooner or later, this should also be reflected in rising prices.