According to the real estate valuation company IAZI, 2023 was characterized by the aftermath of the interest rate turnaround for Swiss real estate investors. Investments in real estate still paid off, but the market is now a long way from the performance figures achieved during the low-interest phase, the company writes in its latest assessment. The investment environment is experiencing an interim low, but the recent reduction in the key interest rate by the SNB promises the proverbial silver lining on the horizon.

Rising mortgage interest rates have left their mark

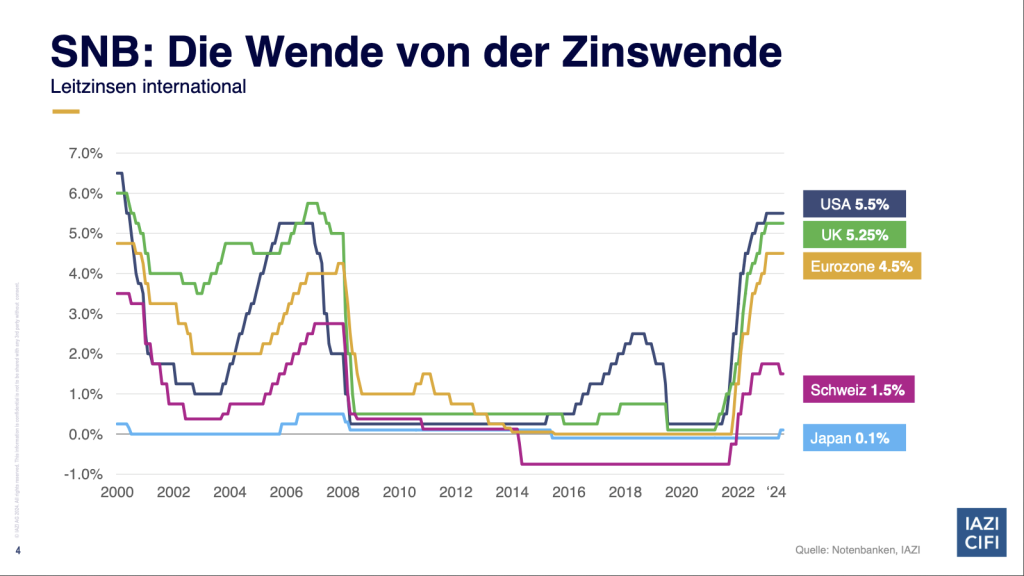

According to the IAZI, the successive increases in key interest rates since the end of negative interest rates in 2022 left a clear mark on the Swiss real estate market at the end of last year. The IAZI Swiss Property Benchmark® figures show that the performance of all property categories declined due to a lack of value appreciation. The figures include performance values, rents, vacancy rates and various property expenses for residential properties, mixed-use properties and commercial properties.

“The performance of yield-producing real estate lost a lot of its appeal last year,” says Prof. Dr. Donato Scognamiglio, Chairman of the Board of IAZI AG. In comparison, other asset classes performed with solid returns in 2023. Swiss bonds, for example, performed at +6.4%, while Swiss equities posted a return of +4.7%. “Money is no longer automatically flowing into the real estate market due to a lack of alternatives.”

However, this decline in market performance should be seen more as a pause for breath than a pause for breath, as the Swiss National Bank’s recent interest rate decision should create a new perspective for the current year. On March 21, the Swiss National Bank (SNB) surprisingly lowered the key interest rate to 1.5 percent. Most economists had expected the SNB to keep the key interest rate at 1.75 percent. If the other central banks follow this example this year, this will probably be the end of the worldwide containment of inflation for the time being, which promises positive signals for the economic development of the industrialized countries. This stimulus should come at the right time, especially for the struggling German economy. Switzerland should also benefit from this, as Germany is our most important partner for foreign trade.

Performance decline in investment property investments

Domestic direct real estate investments (investment properties) achieved a performance of 2.3% at the end of last year (5.2% in the previous year). Performance measures the total return on properties. It shows the rental income (minus expenses) and changes in value that investors have achieved with their properties. The decline in performance is slightly higher for mixed-use properties (2.3%; previous year: 5.5%) than for residential properties (2.9%; previous year: 5.9%) or commercial properties (1.4%; previous year: 4.1%). As a reminder: just two years ago, the performance for commercial properties was 5.6%.

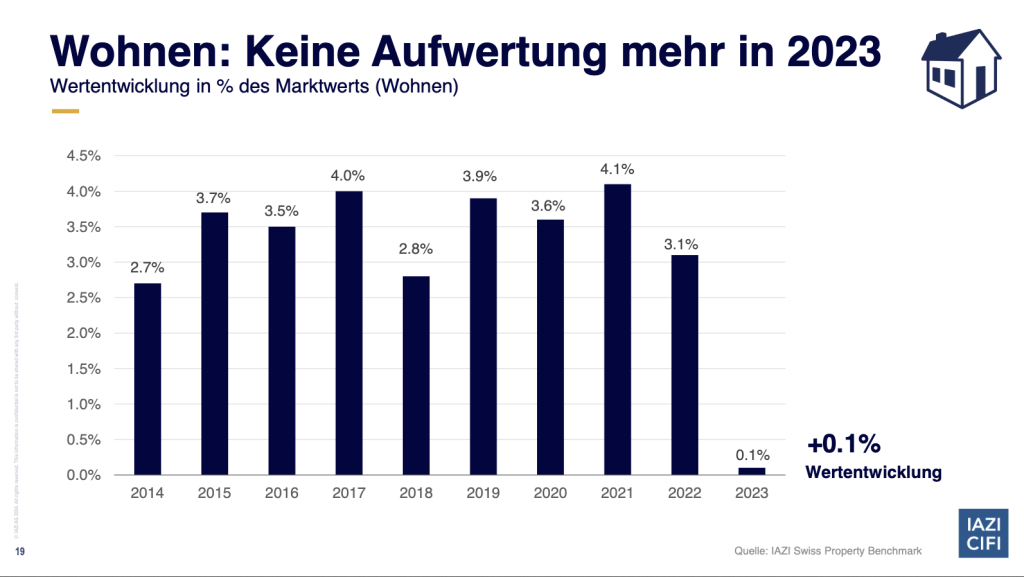

This decline can be explained by the sharp fall in performance. It amounted to -0.6% at the end of last year (previous year: +2.3%). The valuation industry had already been more conservative in 2022, but there was no sign of a trend reversal at the time, as values were still positive across all types of use. “The climate for real estate investors has now become cooler, but there is hope that this is a brief depression,” says Donato Scognamiglio. The value trend for commercial properties was -1.5% (previous year: +1.1%) and for mixed-use properties -0.6% (previous year: 2.6%), while the value trend for residential properties was only just above zero at 0.1% (previous year +3.1%). The cantons of Zug (3.2%) and Zurich (0.5%) still recorded positive performance in the residential sector.

The second component of performance is the net cash flow yield (NCF yield for short). The net cash flow is calculated as follows: Income (actual income) less all property expenses affecting cash outflows (caretaking, administration, heating and ancillary costs charged to owners, insurance, taxes, maintenance and investments), i.e. excluding depreciation and provisions. The NCF yield remains unchanged from the previous year with a total value of 2.9%. Only the values for residential properties have corrected minimally (2.8%; previous year: 2.9%), while the values for the other property classes remain at the previous year’s level. The media often give the impression that real estate investors are achieving dream yields, but the current figures tell a different story. Financing costs have almost tripled since the turnaround in interest rates.

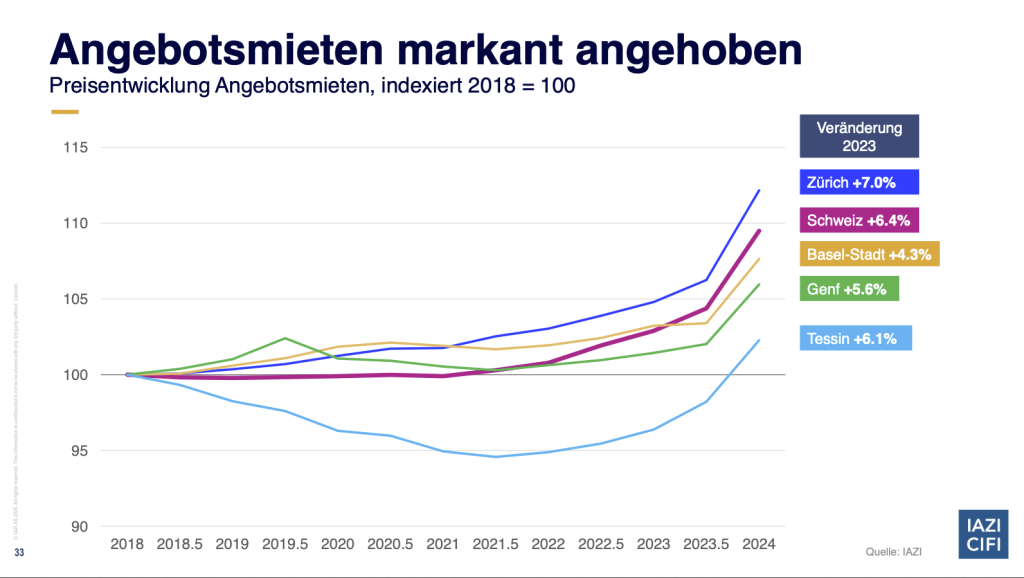

Drastic increase in asking rents

The actual rent calculated in the IAZI Swiss Property Benchmark® (i.e. the target rent less the unrealized rent) is relevant for real estate investors. It currently amounts to CHF 247/m2 of usable space per year and increased by 2.5% at the end of last year. The highest rent increase was achieved by mixed-use properties at 2.8%, followed by residential properties (+2.7%) and commercial properties (+1.1%).

In contrast, asking rents increased significantly last year. The change in the past year amounted to +6.4% across Switzerland. The highest increase in asking rents was in Zurich (+7%), followed by Ticino (+6.1%) and the canton of Geneva (+5.6%). Although landlords are now allowed to raise existing rents under tenancy law due to increases in the mortgage reference interest rate, not all landlords have yet made use of this option. A further increase in existing rents is expected in May 2024; depending on the adjustment already made, this may amount to a hefty 10 percent for some tenants.

On a positive note, vacancy rates have fallen again, not only in residential properties but also in the office sector. In the IAZI Swiss Property Benchmark® , vacancies and their reduction are reflected in a negative value for the so-called unrealized rent. Unrealized rent is made up of vacancies, discounts and rent losses. Across all analyzed uses, the value decreased by 0.4 percentage points to 3.8% at the end of 2023 (previous year: 4.2%). The figure for residential properties fell the most (-0.6%), while the reduction for commercial properties and mixed-use properties (-0.2% each) was more moderate. In the residential sector, vacancy rates are highest in the cantons of Jura (+15.6%), Ticino (+6.9%), Solothurn (+4.8%), Basel-Land (+4.3%) and Valais (+3.8%). These regional differences are sometimes pushed into the background, particularly in discussions about the housing shortage. Immigrants in particular absorb the most living space in urban centers, where most jobs are located or where tax advantages are attractive. For example, vacancy rates are very low in the cantons of Zug (0.2%), Zurich (1.3%) and Geneva (2.4%).

Although vacancy rates have also fallen for commercial properties, the figures remain high. Basel-Landschaft (+7.0%) and Geneva (+9.2%), for example, have high vacancy rates compared to Zurich (+5.4%). The differences are even more drastic at cantonal level. The properties analyzed in the agglomeration municipalities of Wallisellen (+25.5%) and Schlieren (+14.8%), as well as Winterthur (+9.7%), show values that are a major challenge for property owners. In French-speaking Switzerland, the municipalities of Meyrin (canton of Geneva) and Morges (canton of Vaud) recorded peak values of +20.9% and +12.3% respectively. This should fuel the current discussion as to whether vacant office properties can be converted into apartments to alleviate the housing shortage. At present, such projects still face the difficulty that spatial planning prevents such conversions. Political initiatives to make zoning plans more flexible are likely to occupy politicians in the near future.

Positive outlook

Although the investment climate in the real estate market deteriorated last year, there are grounds for optimism for the current year. The recent interest rate cut should ease the situation on the real estate market. In particular, financing costs could fall in the current year, which will have a positive effect on yields and possibly also on value development. However, the potential for appreciation will not be intact again until rents from changes of residence come into play. In contrast to direct real estate investments, indirect investments (real estate funds and real estate shares) performed very solidly last year. For example, real estate funds achieved a return of +5.6% last year. Immigration, which reached a record level last year, should also be seen as a positive demand stimulus. If these figures do not fall significantly, Switzerland’s 9 million population is likely to become a reality as early as this year. It remains to be seen whether the proposals of the “Round Table” initiated by Federal Councillor Parmelin will provide the necessary impetus for residential construction, or whether improvements will also have to be made on the demand side.

About IAZI Swiss Property Benchmark®

IAZI AG provides information on the latest facts and figures for Swiss investment properties from the IAZI Swiss Property Benchmark® updated to the end of 2023. The figures include performance values, rents, vacancy rates and various property expenses for residential properties, mixed-use properties and commercial properties. The analysis of the time series in the IAZI Swiss Property Benchmark® has been based on around 14,766 properties with a market value of around CHF 282 billion since 1994. This makes the IAZI Swiss Property Benchmark® the most representative benchmark for institutional real estate investors in Switzerland. In terms of market value, the entire real estate portfolio consists of 50% residential properties, 20% mixed-use properties and 30% commercial properties.