For the time being, Raiffeisen Switzerland does not see any falling prices in the market for owner-occupied housing, but expects price corrections in 2024. These are only postponed, by no means cancelled, the bank writes in its media release.

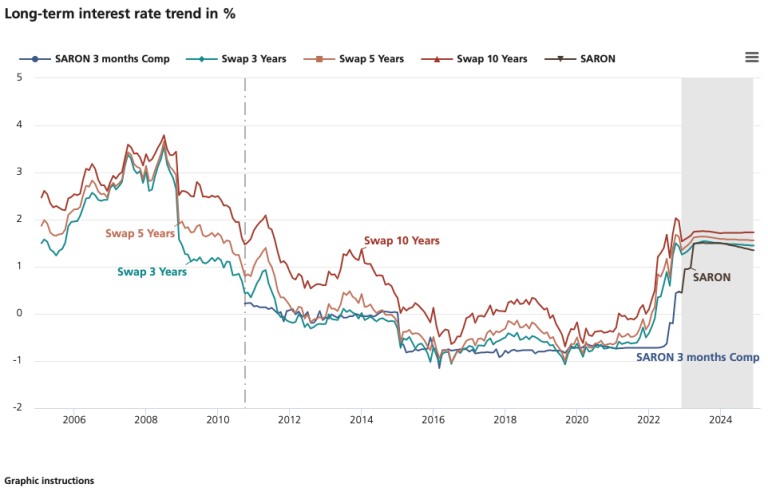

On the owner-occupied housing market, a calming of the price dynamics is still waiting – despite noticeably declining demand and noticeably more liquid supply. Most recently, prices for residential property still rose by over five percent on an annual basis. According to the textbook, the interest rate turnaround should actually put pressure on the price level. However, there is not much sign of this yet. Although buyers are gradually gaining more negotiating power, sellers are still finding buyers for the most part and have therefore hardly adjusted their price expectations yet.

The communiqué continues: “The decreasing number of transactions, however, indicates that diverging price expectations are becoming more frequent. In addition, leading indicators such as the length of listings or the number of search subscriptions now indicate that the 20-year boom in residential property prices will soon come to an end. “We expect residential property prices to undergo a certain correction from 2024 at the latest. After all, the offer prices for residential property have already reacted and are only moving sideways. However, the expected price declines should be manageable. The extremely tight supply will ensure this,” says Fredy Hasenmaile, Chief Economist of Raiffeisen Switzerland.

Rents are likely to rise further

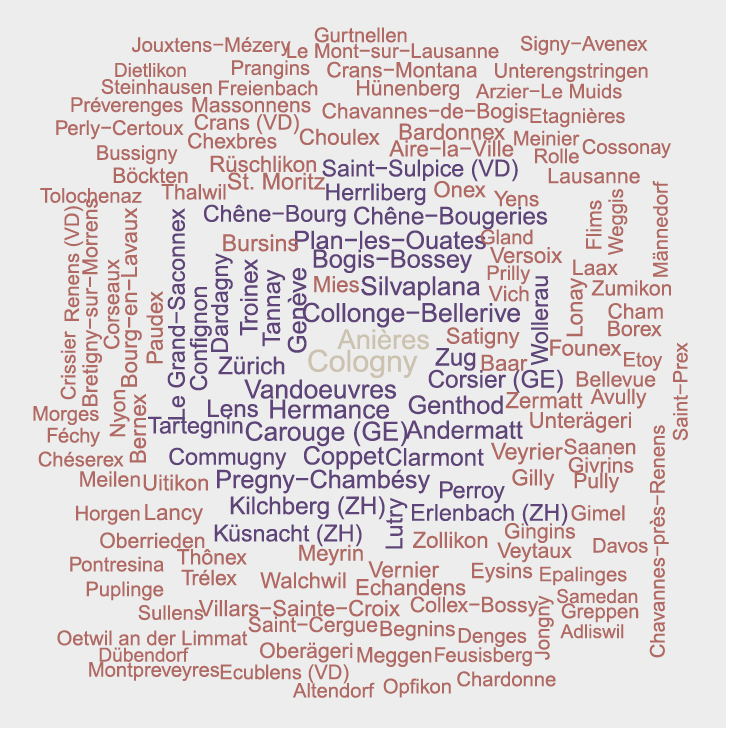

After the first increase in the mortgage reference interest rate on 1 June 2023, the next rent increase is already around the corner, according to Raiffeisen Switzerland. In December, the reference interest rate is expected to rise to 1.75 per cent, which means that a majority of Swiss tenants are threatened with another rent increase on 1 April 2024. Even a third increase by the end of 2024 is already foreseeable. Since landlords often also claim the accrued inflation with the increase in the reference interest rate, the rents of those affected will rise more than the three percent provided for per reference interest rate step. The officially measured rent increase is therefore likely to climb to eight per cent next year in the meantime. “For the most part, landlords can easily enforce these higher rents because the rental housing market is increasingly drying up due to high immigration, far too little residential construction activity and the recent brisk formation of new households,” says Hasenmaile.

Wordcloud: Municipalities with highest median asking rents per m². The higher the rents, the larger the municipality name is shown. Only municipalities with more than 10 listings since the beginning of 2022 considered. Source: Meta-Sys, Raiffeisen Economic Research

Tenants cannot simply move to a cheaper flat, especially since market rents are already rising strongly in addition to existing rents. “Only the restoration of a balance between supply and demand can put a stop to rent increases across the board. This requires more incentives for all developers, and politics in particular would have to turn a few screws to achieve this goal,” explains Fredy Hasenmaile and adds: “Only if institutional, private, cooperative and all other developers quickly launch more flats can the worst consequences of the looming housing shortage still be avoided.”

More information on the Swiss real estate market in the third quarter is available in the Raiffeisen publication “Real Estate Switzerland – 3Q 2023, which you can download as a PDF here.