Real estate investors satisfied with development in 2021

The year 2021 was very successful for Swiss real estate investors. With their domestic direct real estate investments (investment properties), they reached a performance of 6.4% (5.8% in the previous year). This is the best result in seven years. Performance measures the total return of properties. It shows the rental income (minus expenses) and changes in value that investors reach with their properties. The results for commercial properties improved significantly, with performance rising to 5.6% (previous year: 4.5%). This is all the more pleasing as commercial properties were under strong pressure during the Corona pandemic.

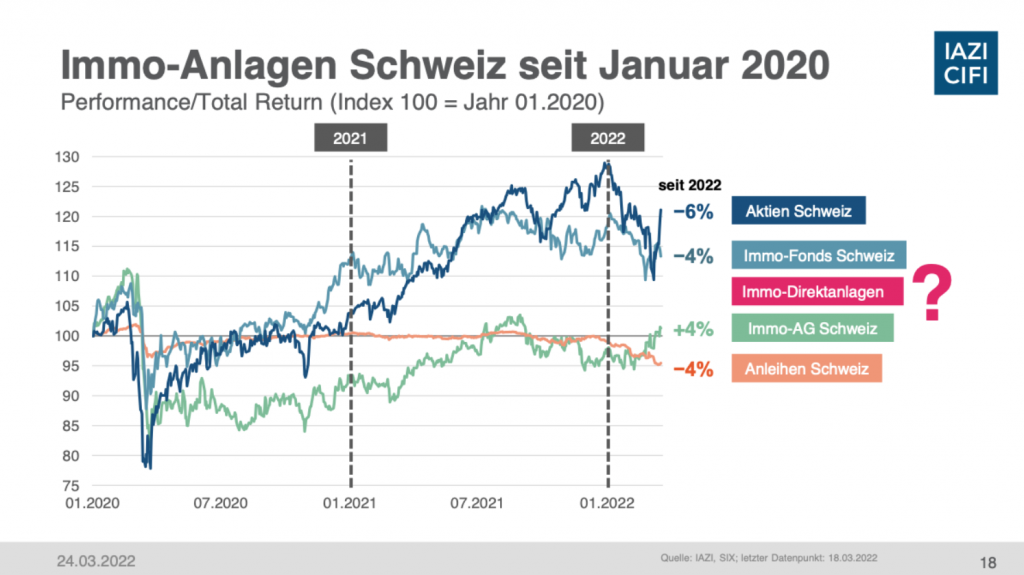

Real estate funds invest primarily in residential properties, while real estate companies tend to invest in commercial properties. These also recovered well at the beginning of 2022.

Investors once again reached some of the best results in 2021 with pure multi-family houses. Their performance is very high at 7.1% (previous year: 6.7%) and is back at the same level as before the pandemic. “These high performance figures are extremely pleasing for investors. They show that optimism has definitely returned to the real estate market last year,” says Scognamiglio, CEO of IAZI at yesterday’s media event. He continues: “When the pandemic broke out in 2020, uncertainty was high and valuations were cautious. There is hardly any sign of that anymore in the past year”.

Market values reach new all-time high

The performance of all analysed Swiss investment properties was an impressive 3.5% in 2021 (previous year: 2.7%). Multi-family houses were extremely sought-after by investors; their market values rose by 4.1% in 2021 (previous year: 3.6%). They thus reached a new all-time high. For commercial properties, the appreciation is 2.7%. “The valuations of commercial investment properties indicate that retail has quite recovered in 2021 and has made a real rebound,” says Donato Scognamiglio.

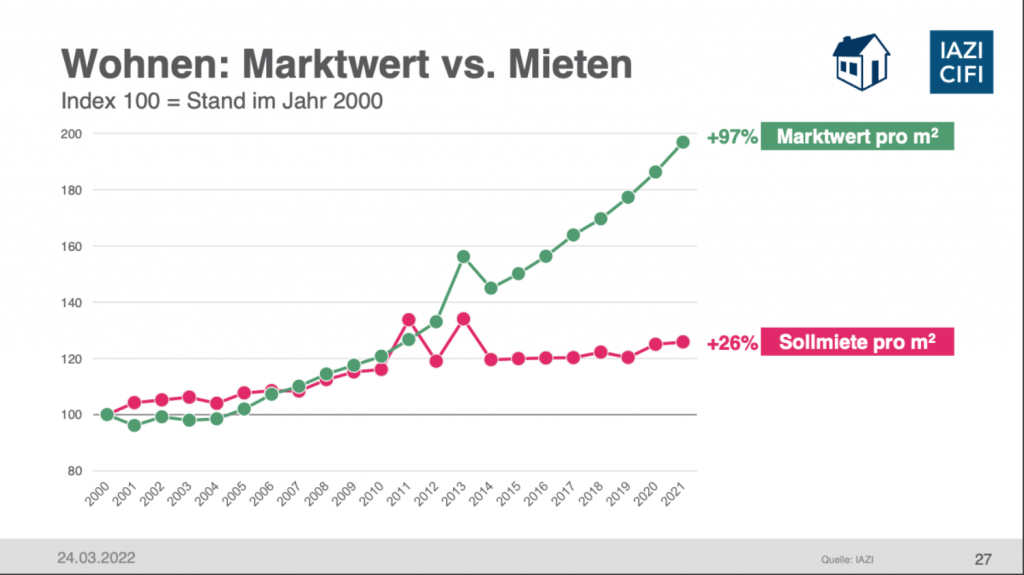

As the last few years have been characterised by falling interest rates and low inflation, the development of rents has decoupled from the development of market values over the last 20 years or so, as rents cannot be adjusted at will under the current rental law. But despite the relatively low increase in rents, investors are apparently willing to pay ever higher values for the apartment buildings.

Whereas rents and market values were fairly congruent until the financial crisis, from 2007/2008 onwards there has been a steadily widening gap between the rent curve and the market value curve. In the last 20 years or so, the market value of Swiss investment properties has almost doubled, while rents have “only” risen by around 25%.

Vacancy rates could be reduced

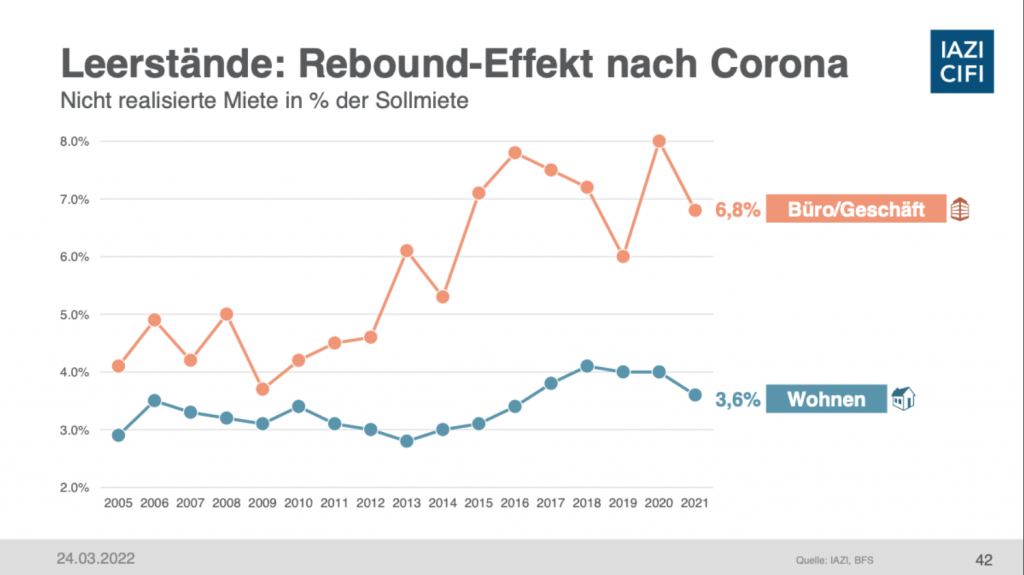

“I also consider it very positive that the market was able to reduce some of the vacancy rates last year,” Scognamiglio continues. Thus, the vacancy rate in 2021 is 5.1% (previous year: 5.9%), which is a significant reduction.

The vacancy indicator used here corresponds to the unrealised rental income, i.e. including rent reductions, discounts and rent-free periods.

The vacancy rates for commercial properties have fallen the most; they are now only 6.8% (previous year: 8%). Due to the high demand for flats, even vacancies in apartment buildings have decreased (2021: 3.6%; 2020: 4.0%). In this analysis, vacancies correspond to unrealised rental income, i.e. including rent reductions, discounts and rent-free periods.

Uncertain outlook: Stagflation fears spread

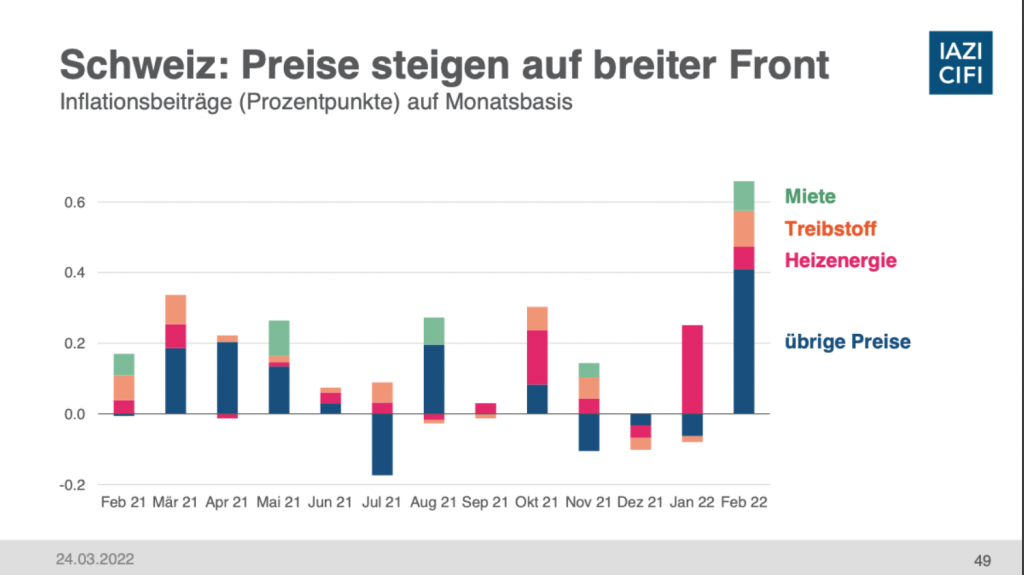

Although the investment property market has shown its best side in 2021 and performance has returned to pre-Corona (2019) levels, the outlook remains highly uncertain. Inflation has arrived in Switzerland and threatens to rise further. Record high energy and fuel prices are not only felt at the gas pumps, but also in the heating of properties and later on in the service charge bill from the tenants.

The situation in Ukraine additionally awakens the desire for “safe” value investments. With its stable character and regular cash flow, real estate remains a sought-after tangible asset against this background.

The US Federal Reserve and the European Central Bank have already ushered in the end of the era of cheap money. The first interest rate hikes have been implemented by the FED. How long the Swiss National Bank will be able to escape this trend remains uncertain at present. In the meantime, inflation has exceeded the target range of 2% set by the SNB.